Why do people love digital wallets?

Lockdowns and remote work have permanently changed the way people consume and pay. As the love for digital wallets is growing, in the near future, we will never have to say ‘Oops, I forgot my wallet.’

Today, we can pay for our daily purchases just with the apps on the mobile phone. On our way to work, we can take out a coffee or buy a small breakfast paying through the app and even earn some points from that. During coffee time, we might order some groceries for dinner or buy clothes from the favourite brand just with a few swipes on the phone. In the process, there is no need to take out the wallet. This is our lifestyle with a digital wallet, also known as a mobile wallet or an e-wallet.

People love to use digital wallets because they are safer and easier to pay with. The pandemic has accelerated their usage, as digital wallets provide a contactless payment experience. This rapid growth can be expected to continue during the next few years.

By reading this blog, you’ll learn:

- What is a digital wallet and how it works

- Why digital wallet adoption is increasing

- Insights from the digital wallet market:

What is a digital wallet? And how it works?

A digital wallet, simply put, is an online service or software program that enables an individual or business to conduct electronic transactions. Also called a mobile wallet, it securely stores the user’s payment method, such as a credit card, an ID document like a driver’s licence, flight tickets and various coupons.

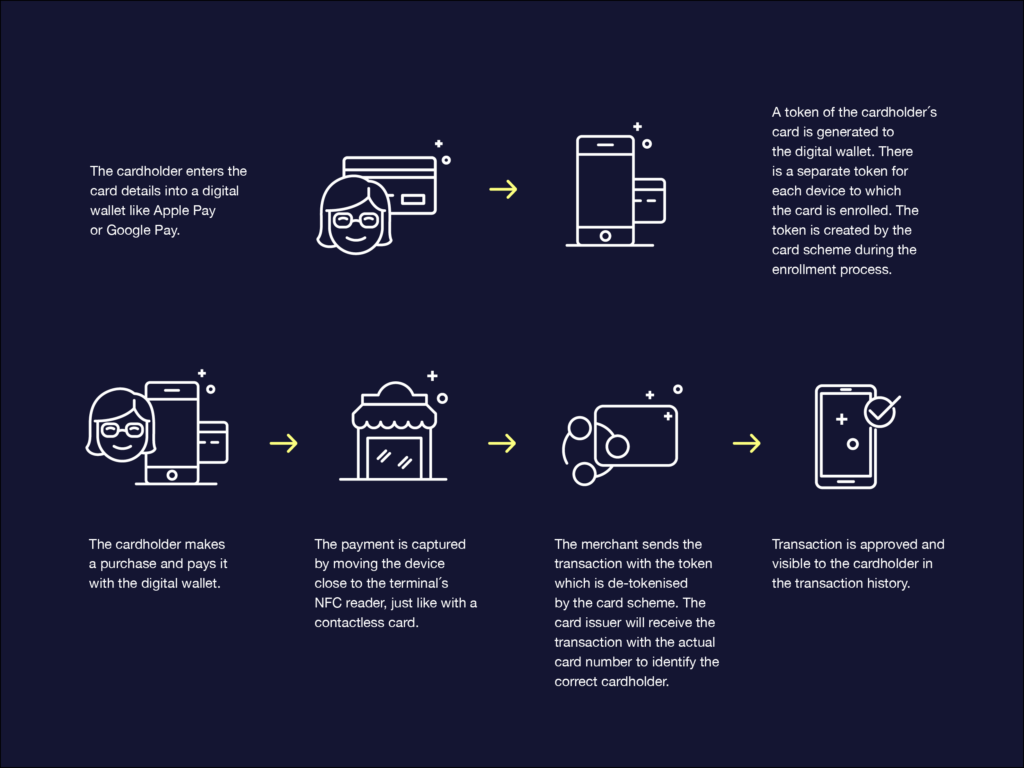

Digital wallets enable users to make purchases easily from their devices like a mobile phone or smartwatch. The most well-known digital wallet apps are Apple Pay, Google Pay, and Samsung Pay, having nearly a billion users in total. The below image explains how these wallets work:

- The cardholder enters their card details into a digital wallet like Apple Pay or Google Pay.

- A token of the cardholder´s card is generated to the digital wallet. There is a separate token for each device to which the card is enrolled. The token is created by the card scheme during the enrollment process.

- The cardholder makes a purchase and pays it with the digital wallet.

- The payment is captured by moving the device close to the terminal´s NFC reader, just like with a contactless card.

- The merchant then sends the transaction with the token which is then de-tokenised by the card scheme. The card issuer will receive the transaction with the actual card number to identify the correct cardholder.

- Transaction is approved and visible to the cardholder in the transaction history.

Why digital wallet adoption is increasing

By the end of 2022, the number of users in digital wallets is expected to reach around 3.6 billion worldwide which is equivalent to almost half of the world population. The increase in mobile payments is not likely to slow down soon, as the market is expected to reach $15.69 trillion by 2028.

The easy and secure end-user experience holds users engaged with digital wallets. And this leads merchants and issuers to adopt and provide digital wallet services. Looking into the different players in the digital wallet environment, we can identify the incentives that have made digital wallets so popular.

For consumers, digital wallets are easy, safe and secure

The time spent on smartphones affects people’s behaviour and, of course, the way they consume. As the time spent using smartphones increases, people are more comfortable with the credit cards inside their smartphones than with the plastic cards in the physical wallet.

Digital wallets typically offer built-in two-factor authentication, tokenisation, and well-defined security protocols. Thus, it is hard to steal the card information, and the process of digital wallet payments limits fraud risks and enhances security. As wallet providers rely on gaining and keeping the trust of the users, they have no choice but to provide a high-security system. Compared to general card transactions, digital wallet tokenization solutions mitigate the risk of security breaches, and two-factor authentication reduces fraud.

In addition, the ability to archive and organise payment records provides consumers with insight into consumption and value-added services.

For merchants, digital wallets bring the benefit of easy payment and customer loyalty

Convenient payment is an important selling factor that benefits not only consumers but also merchants. Inconvenient payment experiences are one of the biggest reasons for increasing consumer churn. Thus, many merchants are embracing digital wallets to provide the preferred payment options to their customers.

In addition, digital wallets increase consumer loyalty and security, as they can be used for personalised marketing and discount vouchers. Solutions integrated into digital wallets make the buying journey easy and attractive, which can lead to increased sales.

For issuers, digital wallets are increasing customer engagement

Consumer behaviour and increasing competition are influencing issuers to adopt digital wallets. More and more issuers are offering digital wallets to acquire new customers and retain existing ones.

Although the pace of development and usage of digital wallets is very different depending on the geographical market and user segment, it is clear that digital wallets have a major impact on payment volumes and revenue when the number of users increases.

For issuers, it is crucial to research the market and customers and thoroughly study the impact the digital wallet could have. Integrating into a suitable digital wallet will create increased user engagement and revenue.

Insights from the digital wallet market

Are you an issuer interested in integrating digital wallets into your card products? If so, here are some digital wallet market insights that you should know. Most people love digital wallets, but the love for digital wallets differs in countries and regions, and it also depends on the kind of digital wallet.

Differences in mobile payment growth across countries

Digital wallets have been used widely around the globe. However, the number of digital wallets and the way they are used differ among countries.

In markets where convenient digital payment infrastructures are in place, such as in Europe or the US, the adoption of a digital wallet has been slower. For example, being able to pay directly by tapping a card is not much different from using a mobile wallet in speed or convenience.

In emerging economies, however, the story is different. Digital wallets are adopted faster and the number of users is increasing rapidly in growing economies. In areas with large populations, such as India and China, digital wallets are easily used not only for digital payment methods but also for population registration management.

However, the regional and demographic commonality is insufficient to characterise digital service journeys. Even within the same market, different types of digital services are being adopted according to the users’ different needs.

Diverse providers in the digital wallet market

There are hundreds of digital wallets around the world depending on the wallet’s capabilities, target market, and end-users, and the number is constantly growing. These various types of digital wallet services are adopted by users for their different benefits and features.

Just to mention a few:

Mobile wallets like Apple Pay, Google Pay and Samsung Pay are available on devices based on the operating system: Apple Pay is only available for iOS-based devices such as iPhone or Apple Watch while Google Pay and Samsung Pay are usable on Android-based devices. The wallets support adding credit, debit and prepaid cards.

Merchant-specific wallets like Walmart Pay allow users to pay by connecting with debit, credit or gift cards and to earn various cash rewards at the merchants’ shop.

Messenger-based wallets like WeChat Pay are more than just mobile payment services, they are functioning as sales and marketing channels integrated with a messenger service. Through these kinds of wallets, users can for instance send money to their friends, pay for goods and services online and top up mobile accounts.

Telco network wallet, like M-PESA, is more like a virtual banking system that provides transaction services through a SIM card. With M-PESA, once the SIM has been inserted into the card slot of the mobile device, users can make payments and transfer money to vendors and family members with SMS messages.

E-commerce and money transfer-focused wallets like PayPal are online payments system that offer online transactions including payment and money transfer by adding debit or credit cards or connecting to the bank account.

Cryptocurrency wallets like Coinbase Wallet are self-custody crypto wallets, enabling users to manage their own crypto, keys, NFT(non-fungible token)s and data in one place.

Each of these digital wallets serves its unique target market, end-user, and market needs identified from different perspectives.

The diversity of the digital wallet market shows that it is difficult to provide a compelling solution with a single wallet for all the market participants, including consumers, issuers and merchants.

The diversification of the digital wallet market is expected to continue, but the focus should be to win the hearts of the users that you target. One way to differentiate themselves in the face of various competitors, some digital wallet providers have come up with a strategy to include other services. PayPal and Apple Pay, for example, are including BNPL (Buy Now and Pay Later) offerings into their core service. By including the BNPL benefit, existing wallet users have the flexibility to consume and have increased spending power.

Continuous growth ahead in digital wallets

Research on digital wallets asserts that the role of digital wallets in future payment will increase rapidly over the next few years. Mobile devices such as smartphones, tablets and wearables are already part of the daily life of billions of people in the world. End-user experiences with improved convenience and security will increase the use of digital wallets. At the same time, the digital wallet domain will remain diverse due to the different behaviours of consumers, regional and market differences, and the lack of one solid attractive solution for all market participants.

As more competition is expected in the market, digital wallet providers are expected to take into account differentiated services considering the environment of targeted end-users and merchants. For example, integrating BNPL services can provide low-cost financing options to end-users, or penetrating smart speaker technology maximises convenience by enabling voice payment. The cryptocurrency penetration is also noteworthy, as the number of holders is constantly growing. After all, the superior end-user experience and attractive features are the keys to the success of the digital wallet service.

Looking for a partner to integrate digital wallets into your product?

Enfuce provides payment services for issuers, fintechs and merchants, supporting their success in rapidly changing markets. Last year, Enfuce implemented over 10 global digital wallets for its European customers, partnering with both Visa and Mastercard. This year, we expect to see significant growth with more than double the number of digital wallet projects.

Enfuce has driven the launch of global digital wallets like Apple Pay and Google Pay in the Nordics. In 2017, Apple Pay was first launched in Finland, as Enfuce concluded the first implementation project with its customer.

By combining industry expertise, innovative technology and compliance, Enfuce delivers scalable and sustainable payment solutions quickly and securely. If you want to expand your offering with digital wallets and mobile payments, here we are, a reliable partner with rich experience and industry insight. Build the best digital wallet integration for your product together with Enfuce. Contact us!