Enfuce Open Banking Services

Deliver on the power and promise of PSD2 and open banking by becoming fully compliant and giving third-party service providers access to digital accounts.

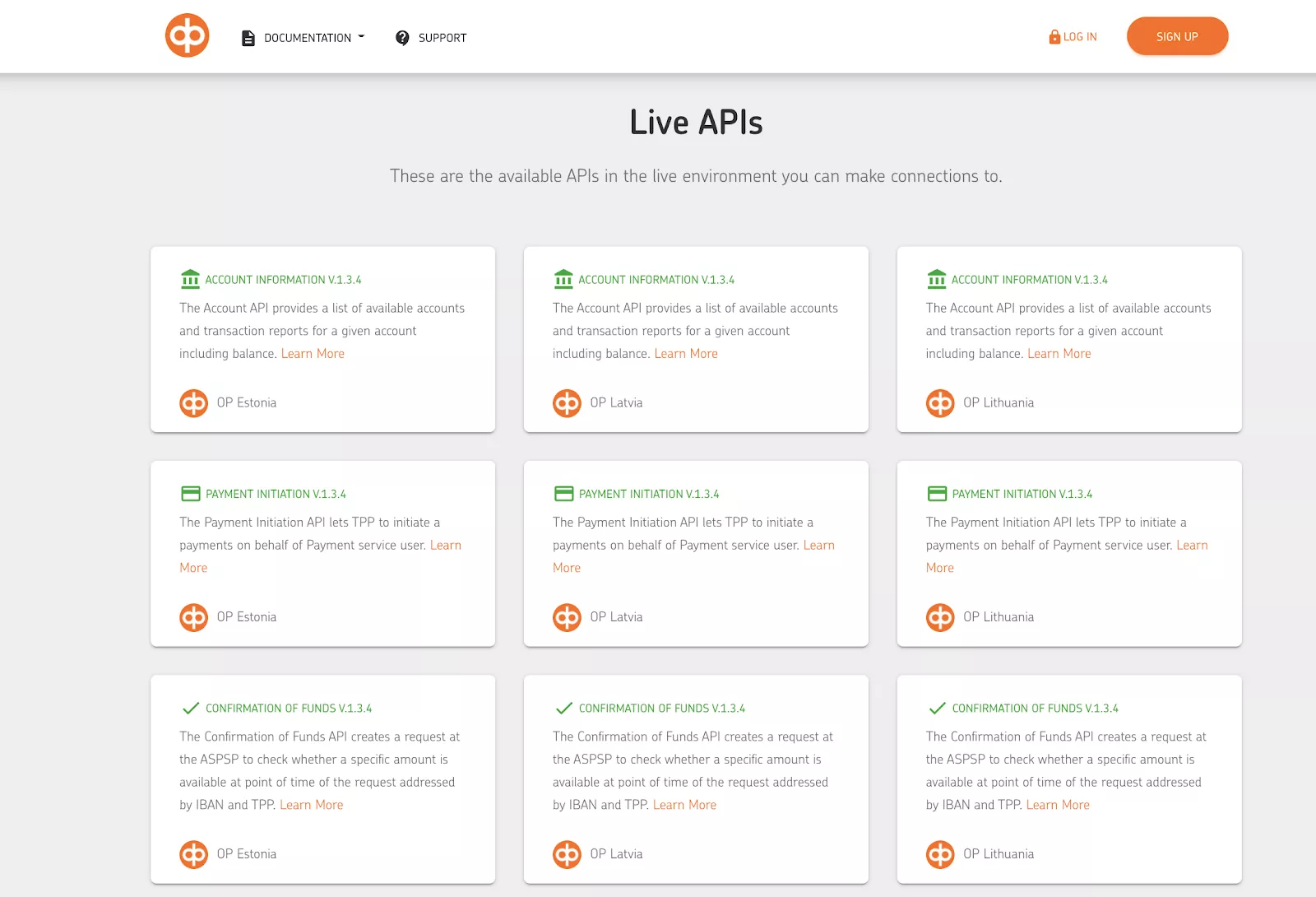

We specialise in open banking APIs and help you become fully PSD2 compliant

Our cloud-based open banking services minimise the operational impact and maximise the potential of open banking. You can focus on growing your core business by delivering the features and products that your customers want and we take care of compliance and APIs for you.

Regulatory compliance

Our open banking compliance service goes much further than APIs or sandbox test environments. We also handle third-party provider (TPP) validation, consent management, fraud monitoring, dispute handling, compliance reporting and much more. We help banks and financial institutes with the lifecycle of PSD2, so that you are always compliant and prepared for the changes PSD2 will bring to the market.

Read more

How to become a PSD2 compliant card issuer

Download your copyPSD2 opens new opportunities for card issuers. What specific issues to take care of to become PSD2 compliant? Download our whitepaper to find out!

Enfuce’s service enabled us to meet and exceed all PSD2 requirements, and tap fully into the opportunities of open banking. With Enfuce’s platform and industry-leading expertise, everything was taken care of — from the fine print to fully deployed APIs.

Jari Jokisilta, Head of Baltic Development and Maintenance, OP Corporate Bank, Baltic Banking

Read more