Fuel payments are changing fast.

Legacy systems can’t keep up with digitalisation, compliance demands, and the shift to EVs. You need a secure, scalable, and future-proof solution that works across fuel, EV charging, and mobility. That’s where Enfuce comes in – helping fleet operators navigate an evolving landscape with ease.

What’s holding fleet payments back?

- Outdated systems – Slow, rigid infrastructure makes it difficult to scale, adapt to new technologies, and stay competitive.

- Fragmented payments – Multiple cards for fuel, EV charging, and expenses create inefficiencies and extra admin work.

- Compliance – PSD3, PCI DSS, and EU AFIR require modern, open-loop payment systems, making legacy solutions obsolete.

- Fraud risks on the rise – Skimming, unauthorised purchases, and outdated security threaten profitability. Without proactive fraud prevention, businesses face revenue losses and operational disruptions.

- The EV shift is here – Mixed-fuel fleets need hybrid payment solutions that cover both fuel and electricity in one card. Fleet managers need a simple, streamlined way to handle both.

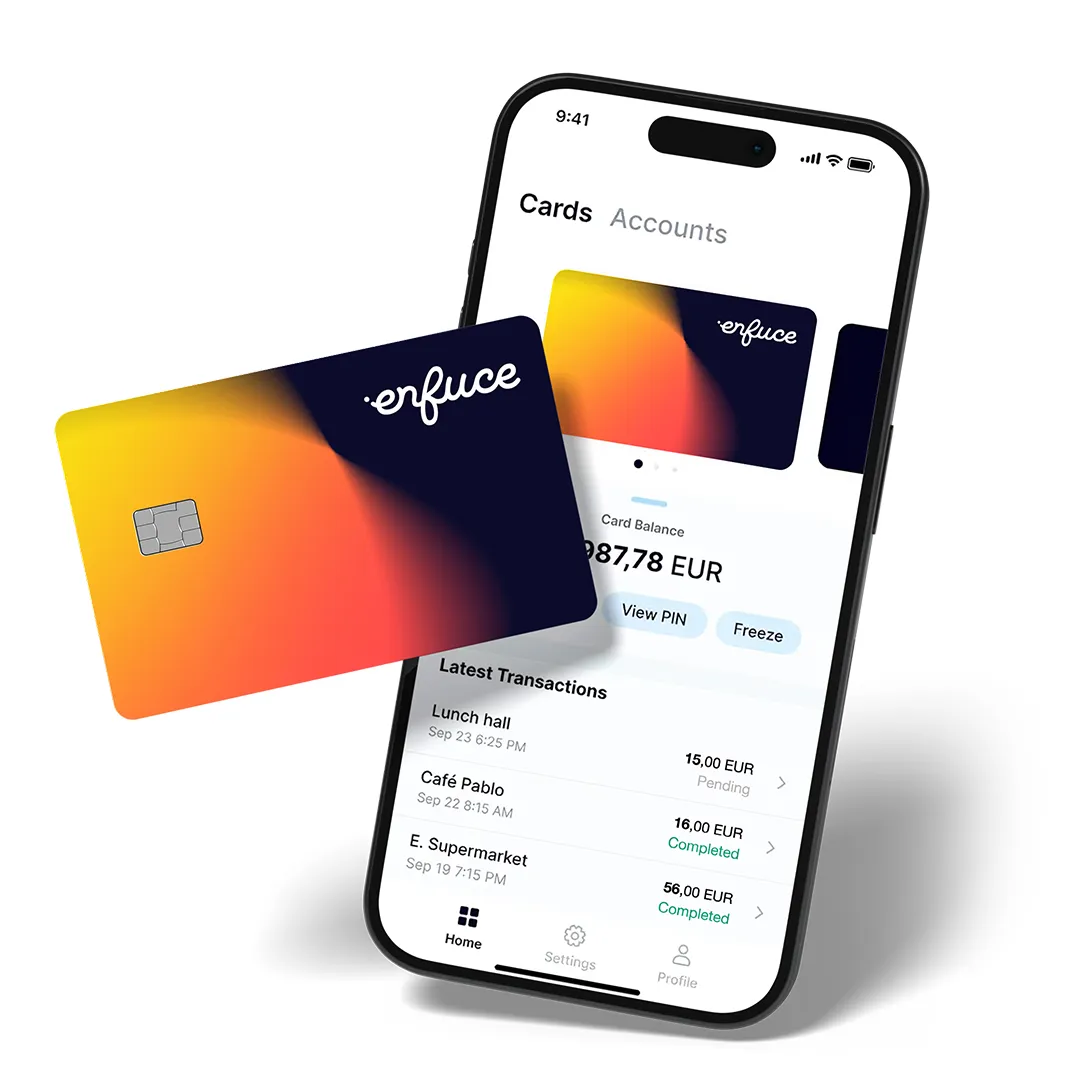

The solution: one card, total control

Enfuce’s Visa Fleet 2.0-compliant fuel cards streamline payments, enhance security, and give fleet operators full control over expenses.

- Fuel and EV in one card – Pay for fuel, EV charging, tolls, and mobility services with a single, seamless payment solution.

- Open-loop & closed-loop options – Configure to fit your business model. Whether you prefer the flexibility of open-loop payments or the controlled environment of closed-loop systems, we’ve got you covered.

- Real-time spend controls – Set custom rules by fuel type, location, budget, and time of day, ensuring full visibility and control over spending.

- Cloud-based agility – Scale faster with a flexible, API-driven system that integrates with your existing fleet management tools. No need for costly infrastructure updates – our cloud-native platform does the heavy lifting.

- Fraud protection built-in – AI-driven risk monitoring and instant security alerts keep every payment secure. Our machine learning models continuously evolve, detecting and preventing suspicious transactions before they happen.

- Data insights that drive efficiency – Track every transaction in real time, optimise expenses, and gain smarter financial insights for better decision-making. With powerful analytics at your fingertips, you can improve cost management and fleet performance.

Fleet payments are changing. Stay ahead

- Digital-first payments – Digital wallet transactions are set to double by 2026 (FIS Global Payments Report).

- EV adoption is accelerating – 73% of fleets plan to transition to electric, hybrid, or hydrogen within five years (Visa report).

- Fraud prevention matters – AI-driven monitoring and chip-based cards significantly cut fraud risks.

- Real-time insights drive efficiency – Fleet operators demand full transaction visibility and data-driven spend optimisation.

How businesses use Enfuce fuel cards

Mixed fleet management

Challenge: Managing both fuel and EV expenses with separate cards creates inefficiencies, increases administrative work, and complicates expense tracking.

Solution: One hybrid card enables seamless payments for fuel, EV charging, tolls, and other mobility services, with custom spend controls to optimise costs and prevent unauthorised spending.

Modernising fuel card programs

Challenge: Many fuel issuers rely on outdated legacy systems, making it difficult to support new payment technologies and transition to open-loop solutions.

Solution: Enfuce enables a seamless migration to a Visa Fleet 2.0-compliant, cloud-based payment system, ensuring future-proof, scalable, and secure transactions.

Expense control for corporate fleets

Challenge: Limited visibility into fleet spending makes it difficult to track expenses, prevent overspending, and ensure compliance with company policies.

Solution: Advanced spend controls allow businesses to set limits by budget, location, merchant type, time, and more ensuring better cost management and regulatory compliance.

Fraud prevention for fuel cards

Challenge: Fuel card fraud, including skimming, unauthorised purchases, and account misuse, costs businesses millions in financial losses and operational disruptions.

Solution: Enfuce’s AI-driven fraud detection continuously monitors transactions, instantly identifies suspicious activity, and enables automated dispute resolution to reduce risk and minimise financial exposure.

Protect every transaction. Optimise every expense

AI-powered fraud detection

Stop unauthorised transactions in real time with intelligent, automated risk monitoring.

Custom spending rules

Control payments by fuel type, location, or merchant to prevent misuse.

Automated chargebacks

Fast, seamless dispute management that minimises administrative burdens and protects your bottom line.

Scalability and flexibility

Effortlessly manage thousands of cards with configurable settings for fleets of any size.

Real-time spend insights

Get instant visibility into transactions with detailed reporting and analytics to optimise costs.

Seamless integrations

Connect Enfuce’s API-driven payment solutions with your existing fleet management systems for a smooth, automated experience.

Why Enfuce? The future of fleet payments

- First Visa Fleet 2.0-certified issuer processor in Europe and UK

- Supports fuel, EV charge cards, and mixed fleet payments

- Seamless closed-loop to open-loop migration End-to-end fraud prevention and compliance (AFIR, PCI DSS)

- Real-time spend tracking and smart expense controls