Offering Flexibility with Digital-first Card Experiences

Make your card experiences outstanding

Contact UsIn a digital-first era, where digital payments is undoubtedly on the rise and cash in decline, the use of cards and digital wallets will continue to co-exist – as usage varies by country, age, values, personal preferences, and life circumstances. It will be a sliding scale, as people shift to digital at different rates – and even as they do, some will use purely virtual, others will want digital to work alongside existing physical cards and others may prefer physical cards only.

Give customers choice and flexibility, by innovating with a variety of physical and digital card offerings linked to individuals’ values, ethics and lifestyle choices.

Our modularity and flexible features enable issuers to create truly unique and seamless customer experiences.

What does modern card issuing look like for the cardholder?

Easy to get started

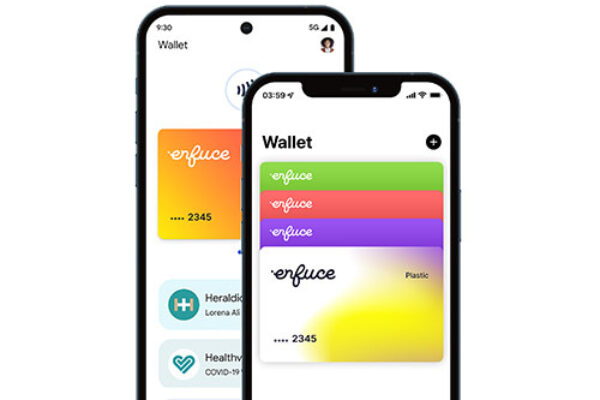

A standout cardholder experience starts with smooth onboarding. Enfuce supports instant issuing for both physical and virtual cards, meaning cards are immediately available to use for online payments. Cards can also be added to digital wallets like Apple Pay and Google Pay as part of the initial signup flow, reducing user friction and registration drop-offs. You can offer unique card art to build your brand and help identify cards in digital wallets effortlessly.

Furthermore, not all customers need or want a physical card, but don’t necessarily want to decide during onboarding. Our phygital option let your customers decide at any time in their lifecycle, whether they want a physical card.

You can offer a disposable card, which is a virtual card, disposed of after a certain pre-defined period, combine multiple card applications (PANs) into one physical card and combine a debit and credit card into one physical card.

Our API-first approach, data exports and real-time notifications about different card life cycle events enable you to create the onboarding and user experience every cardholder wishes they could have.

Read more about Enfuce digital Wallets

Easy and secure to pay

We believe payment experiences should be smooth and straightforward for cardholders. Enfuce’s payment processing has an exceptional 99.999% uptime, which means cardholders can trust that payments go through. All while Enfuce’s optimised 24/7 fraud prevention runs in the background, keeping everything safe without unnecessarily blocking transactions.

With our experience operating in different geographies, we know how important it is to align authentication processes with local expectations. As a result, Enfuce supports many different ways to do Strong Customer Authentication (SCA) for 3D Secure during online checkout.

Real-time transaction notifications let your cardholders know instantly what’s been purchased, making it easier to track spend, and giving payments an additional layer of security.

Read more about Enfuce’s inhouse 3D Secure

Easy to manage

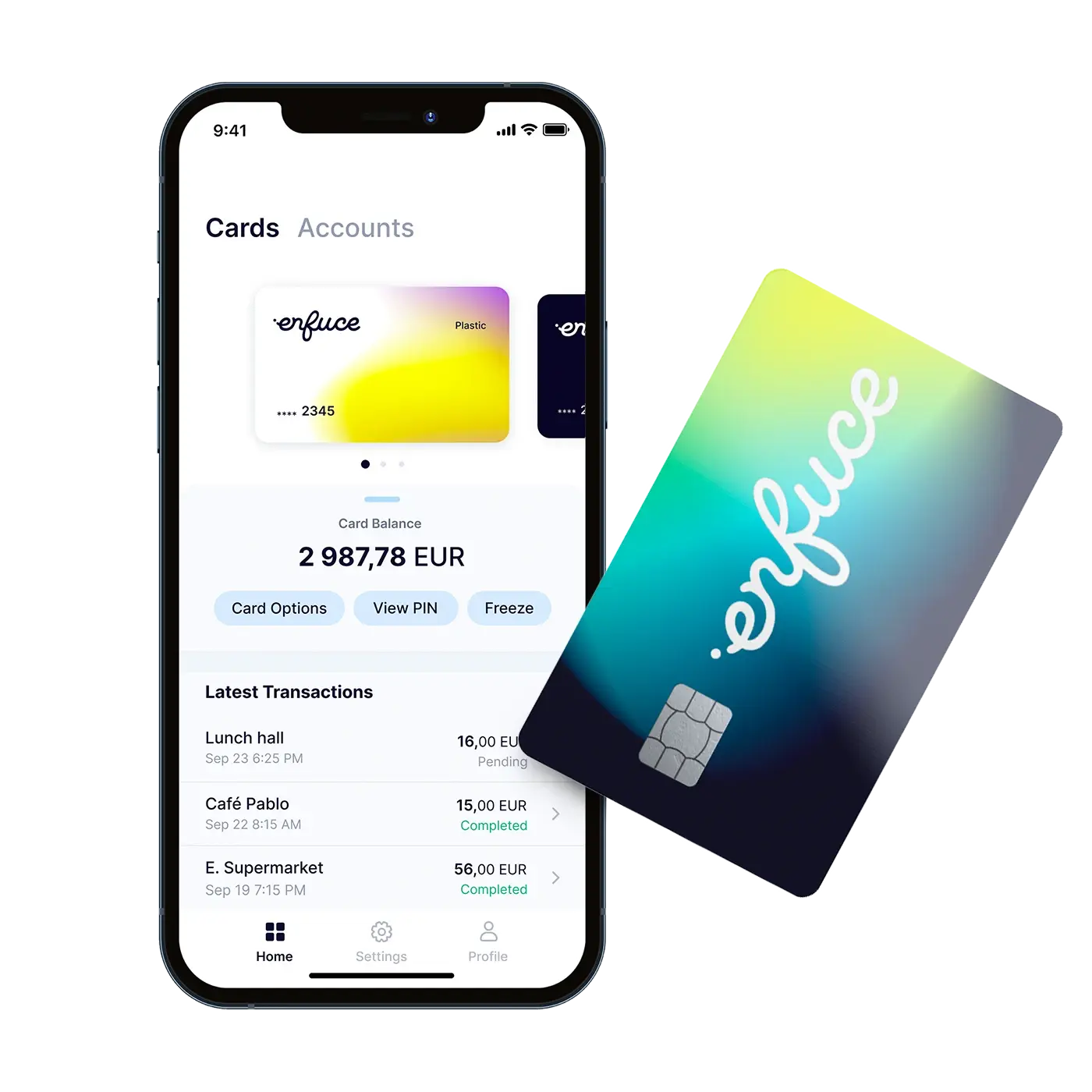

Enfuce’s modern and flexible APIs enable cardholders to manage many aspects of their card via their desktop or mobile application. What does this mean for cardholders?

Goodbye, paper PIN letters. Hello, better UX. Enfuce makes it easy to securely include the view card and set and view PIN functionalities into your application while keeping you as the card issuer out of PCI scope. Cardholders can choose their own PIN and easily check it when needed. They can set the PIN before a physical card arrives and change it at ATMs. And they can access key card information before it arrives, so they can start making e-commerce purchases instantly. It’s the kind of flexibility customers want and expect.

Cardholders can also freeze, geo-block, cancel, and reorder cards themselves. These features give them a greater sense of control, especially in time-sensitive situations when a card has been lost or stolen, and they want to mitigate the risks of fraudulent activity.

Contact us

Pick and choose from a range of features, to offer a differentiated digital first card experience

View card and PIN information – and provide PIN flexibility

Allow your cardholders to safely and conveniently access the data required for making an e-commerce purchase, without having access to a digital wallet or a physical card. For PIN flexibility, enable your customers to log into online banking to both set their PIN before a card arrives, as well as view their PIN – if they have forgotten it for example. Or why not give them the option to change their PIN at ATMs if that is their preference.

True instant issuing for physical cards that can be used straight away

Give your customers the same issuing experience with physical cards, as they have with virtual cards, with no need to wait to start paying with a new physical card.

Let’s get phygital

Create the omnichannel payment card experience in the phygital environment. Not all customers need or want a physical card, but don’t want to decide during onboarding. Show how much you value your customers’ choices by letting them decide at any time in their lifecycle, whether they’d like a physical card sent to them.

Digital wallets from Enfuce

This is an add-on service where digital wallets can be implemented for any card product – prepaid, debit and credit . Enfuce has been certified with the leading digital wallet providers and meets their technical requirements. Enfuce is also compliant with the card schemes, which ensures secure and seamless integration projects where multiple parties are involved.

Unique digital card artwork

Offer different digital card artwork options for the same product – within the same licensed BIN range .

Different card types

The world is changing, but customer preferences still differ, with many alternative use cases. So, we at Enfuce support different card types – virtual, physical or digital.

Want to know more? Contact us!

FAQ

Do I have to use all the digital-first features in this list?

No. Enfuce has a modular approach, which means you pick and choose modules and features that you want. You can pick those features that are relevant to your business, customers and product goals.

If we don’t feel we need these features now, can we change in future?

Yes. We’re all about flexibility at Enfuce and are constantly adding new features to help you drive innovation. You might not be at the stage of readiness for some now, but may wish to add them in future, as your offering matures. That’s totally fine and we’ll be with you along the way.

Why does cardholder UX matter?

Not only does it help you stand out in the market, but it fosters user trust and enhances your brand perception. Cardholder experiences build a foundation to deepen the financial relationship through loyalty programs, payment options like instalments, and other value-adding services.

How can I start testing out Enfuce?

You can create an account in our customer portal MyEnfuce for free, read our API documentation and play around in our sandbox.