Get your card programme live hassle-free with Enfuce Programme Management

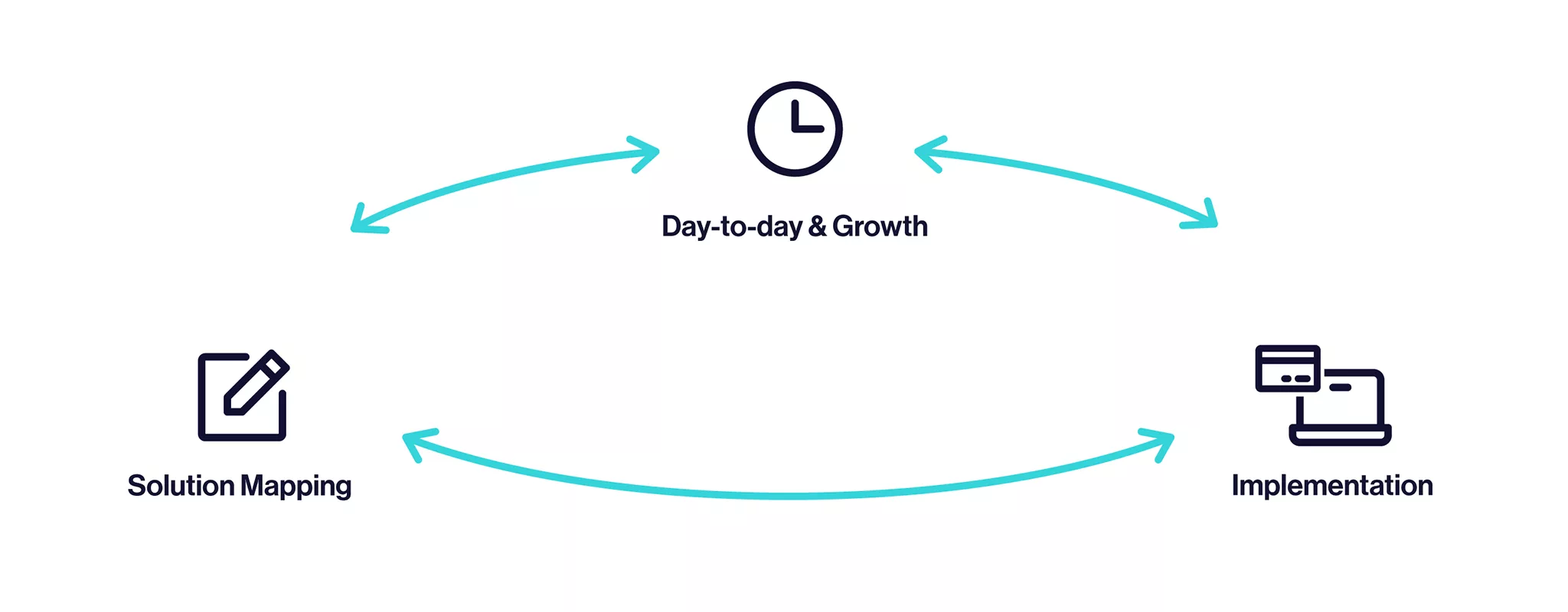

Card programme management ensures your cards go live smoother, which means significant operational savings. We guide your lean team in building a compliant and scalable payment card system for your business. You have access to our award-winning, certified experts and their knowledge to get the most out of your card business. This service covers:

1. A strategic function where we make sure that your card product is set up and scoped to achieve your goals. We also look beyond today to see how you can grow and maximise the business potential of your cards.

2. An operative function that connects you to schemes and needed licences. It keeps your card business always compliant, trains your staff, handles second-line support, manages fraud, and consolidates disputes.

How card programme management helps you throughout your journey

“We were looking for a payment processing partner that would not just provide a quality service with a strong technological foundation, but also understand our growth vision and help us get there. With Enfuce, we found a trusted, competent partner that goes the extra mile to implement card solutions enabling the smoothest possible experience for our customers in six markets.”

Niccolo Perra, CTO and Co-Founder at Pleo