Effortless migration to modern payment solutions

Transform your customer payment systems without the stress - partner with Enfuce for a seamless transition.

Contact usThe challenge of migration

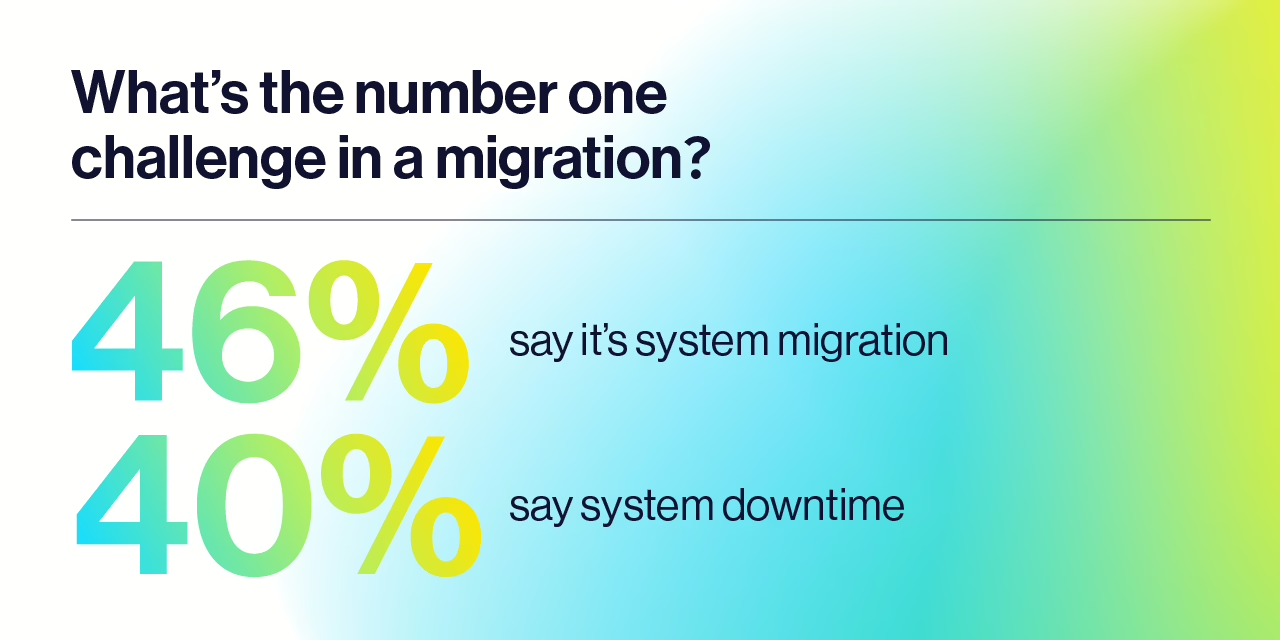

Migrating to a modern cloud-based payment system can feel overwhelming. Risks to customer experience, internal operations, and timelines are major concerns. Without the right partner, migration complexity can halt progress, leaving your business vulnerable to outdated systems and lost opportunities. System migration (46%) and system downtime (40%) are the top concerns.

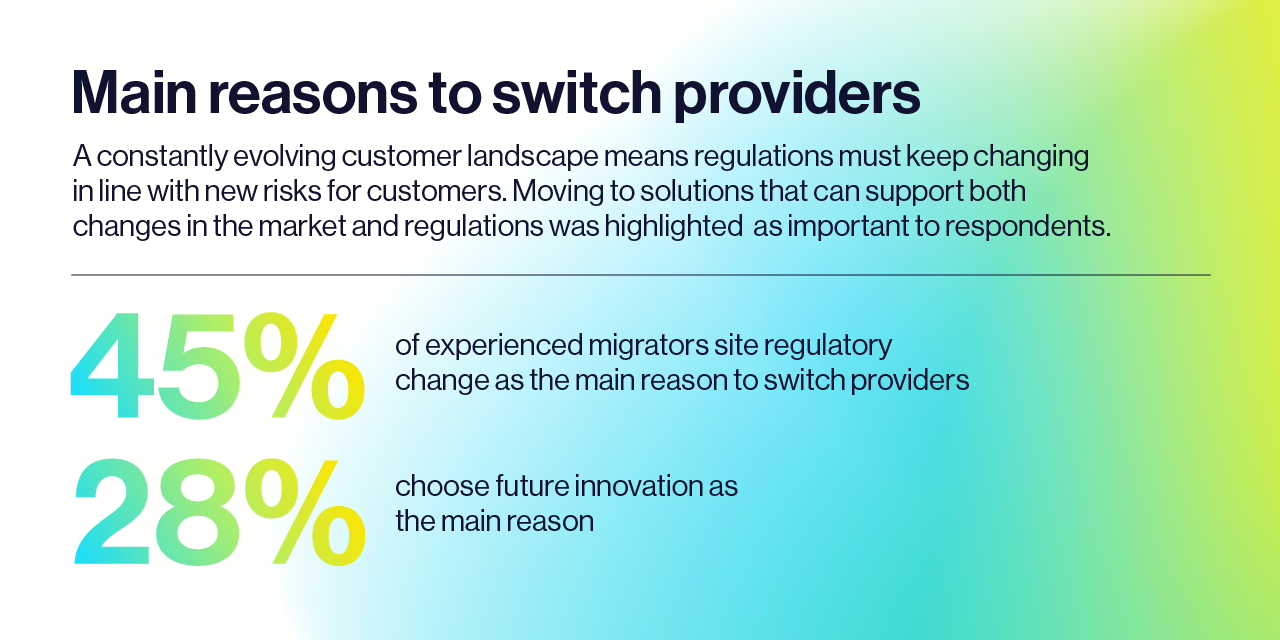

Key drivers of card issuer processor migration.

Our proven 7 step migration process

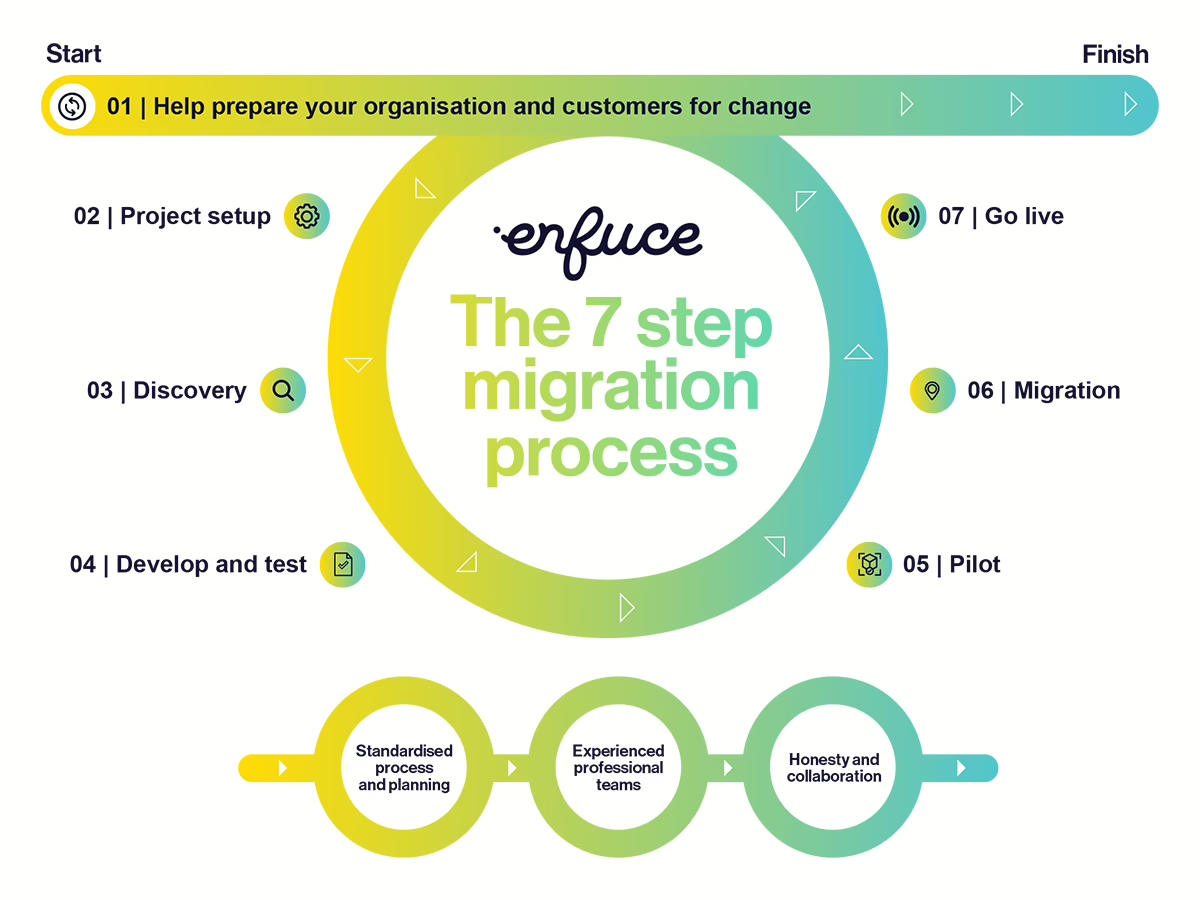

Whether you’re transitioning from one cloud platform to another (cloud-to-cloud migration) or moving from an on-premises system to the cloud (legacy-to-cloud migration), Enfuce’s expertise guarantees a smooth and efficient process tailored to your needs.

We eliminate the stress of migration with our proven 7-step process, designed to ensure a smooth and efficient transition that your customers won’t even notice.

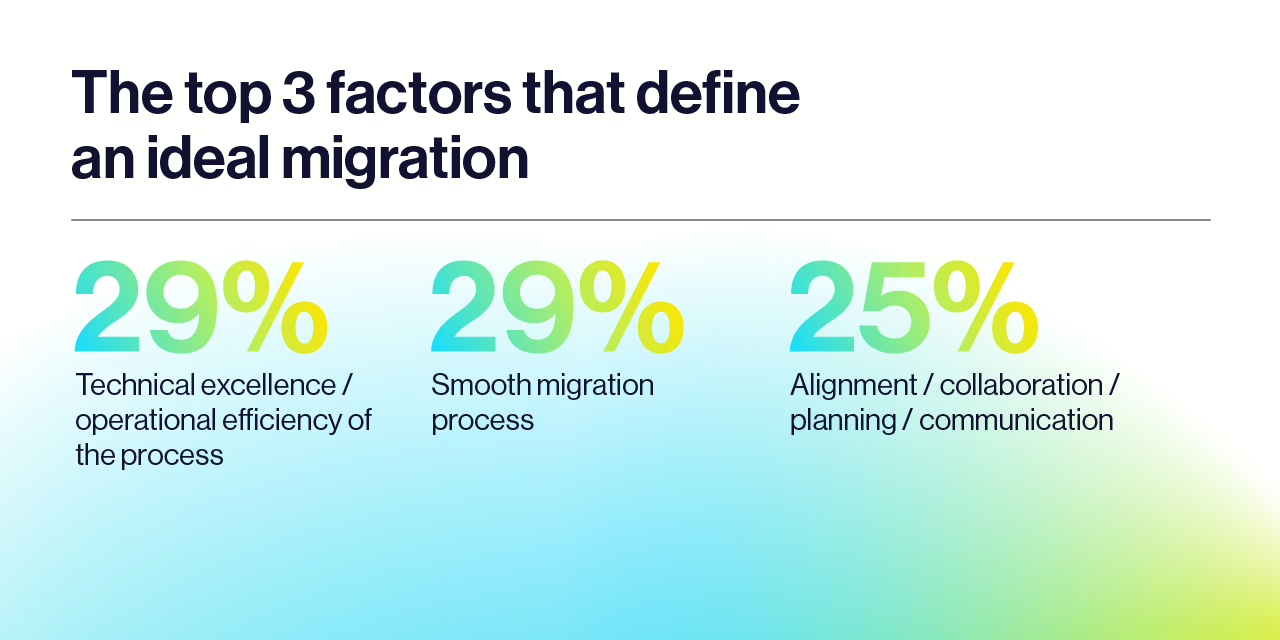

- Smooth migration process – Addressing all risks upfront.

- Technical excellence – Industry-leading standards for performance.

- Collaboration & planning – A tailored, team-focused approach.

Enfuce's 7-step guide to smooth card programme migration

By being meticulous, doing the right thing at every step, and working together, we can minimise risk and ensure a smooth switch for both your customers and internal employees.

Pleo on their migration experience with Enfuce

“Switching from one processing partner to another is like a lung transplant—it has to be perfect. With Enfuce, we found a true partner, not just a supplier. The migration was smooth, and we felt supported every step of the way.”

Thorbjørn Fink, COO of PLEO

Thorbjørn talks about Pleo’s key criteria for selecting a migration partner in the payments sector and how important it was to ‘test’ the relationship from the beginning, since they planned to transfer existing customers onto the new platform.

Contact usFrom Why to Wow – Migration Considerations & Success Factors

On the menu:

- Discover why regulatory compliance is the top driver for card program migration.

- Explore why innovation ranks as a key factor in selecting card program partners.

- Understand how insufficient support prompts companies to seek new providers—and how to ensure your next partner offers strong migration and ongoing support.

- Learn about the critical role of integration in migration, an often-overlooked area that, if neglected, can quickly become your biggest pain-point.

Explaining how it works

Our overview simplifies the migration process, providing clear, actionable insights into each step. Gain the confidence and knowledge you need to ensure a seamless transition to modern payment solutions.

Read our solution brochure for more insights