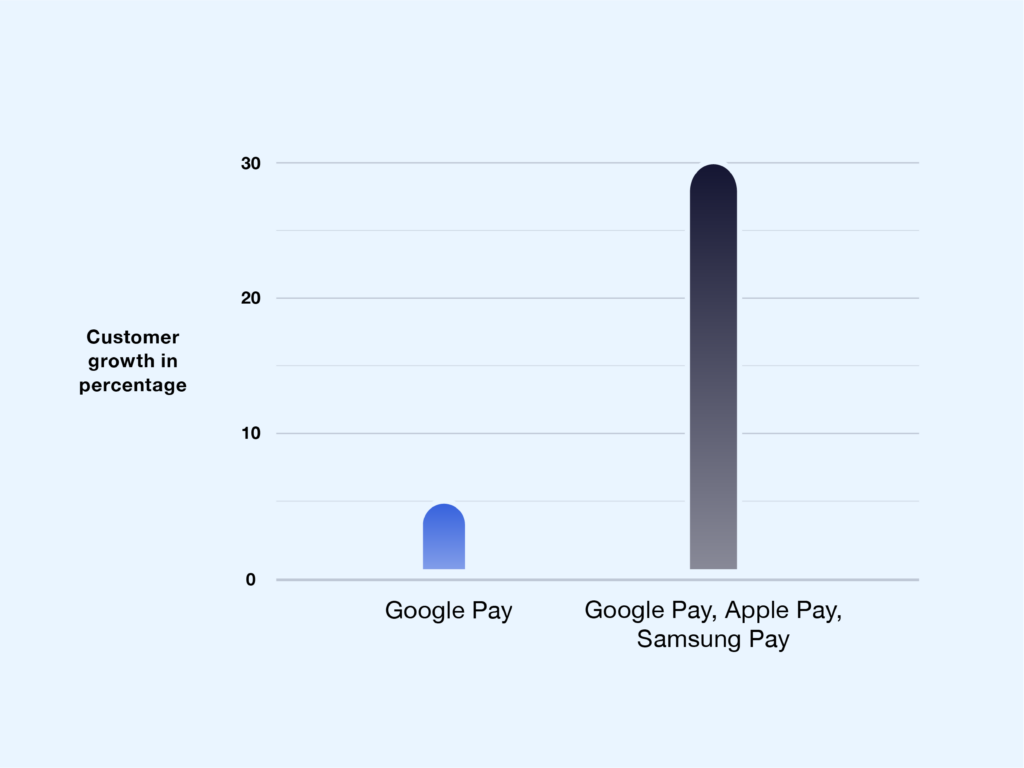

Case study: Enabling multiple digital wallets improved neobank’s customer growth up to 30%

Product feature: Digital wallets

Challenge: How to attract more customers as a new challenger in the market

A Nordic neobank faced two challenges while developing its digital wallet offering strategy. Firstly, people do not want to change their phone or bank to enable a certain digital wallet. If the digital wallet is not available with the bank or mobile phone currently used, the user is reluctant to use it. Secondly, it is not easy for neobanks to enter the bank market competing with large-scale banks that have been established through generations. Therefore, it is essential to offer differentiated services to attract new customers.

Solution: Providing all three largest digital wallet options to the customers

This neobank provided all three of the largest digital wallets in the market: Apple Pay, Google Pay, and Samsung Pay. While implementing all three major digital wallets might sound cumbersome and time consuming, together with Enfuce, the integration projects took only a few months combined. This was achieved by proceeding with the different integration projects partly in parallel. With multiple digital wallet options, consumers can choose the digital wallet that suits them considering their choice of mobile device.

Outcome: 30% growth in customers and 50% activation rate of digital wallets

The result is a 30% growth in customers for the neobank’s payment card product, compared to the phase when they only offered Google Pay.

Today, this neobank sees an increase in the number of its digital wallet users every day. More than 50% of customers who apply for payment card products activate digital wallets.