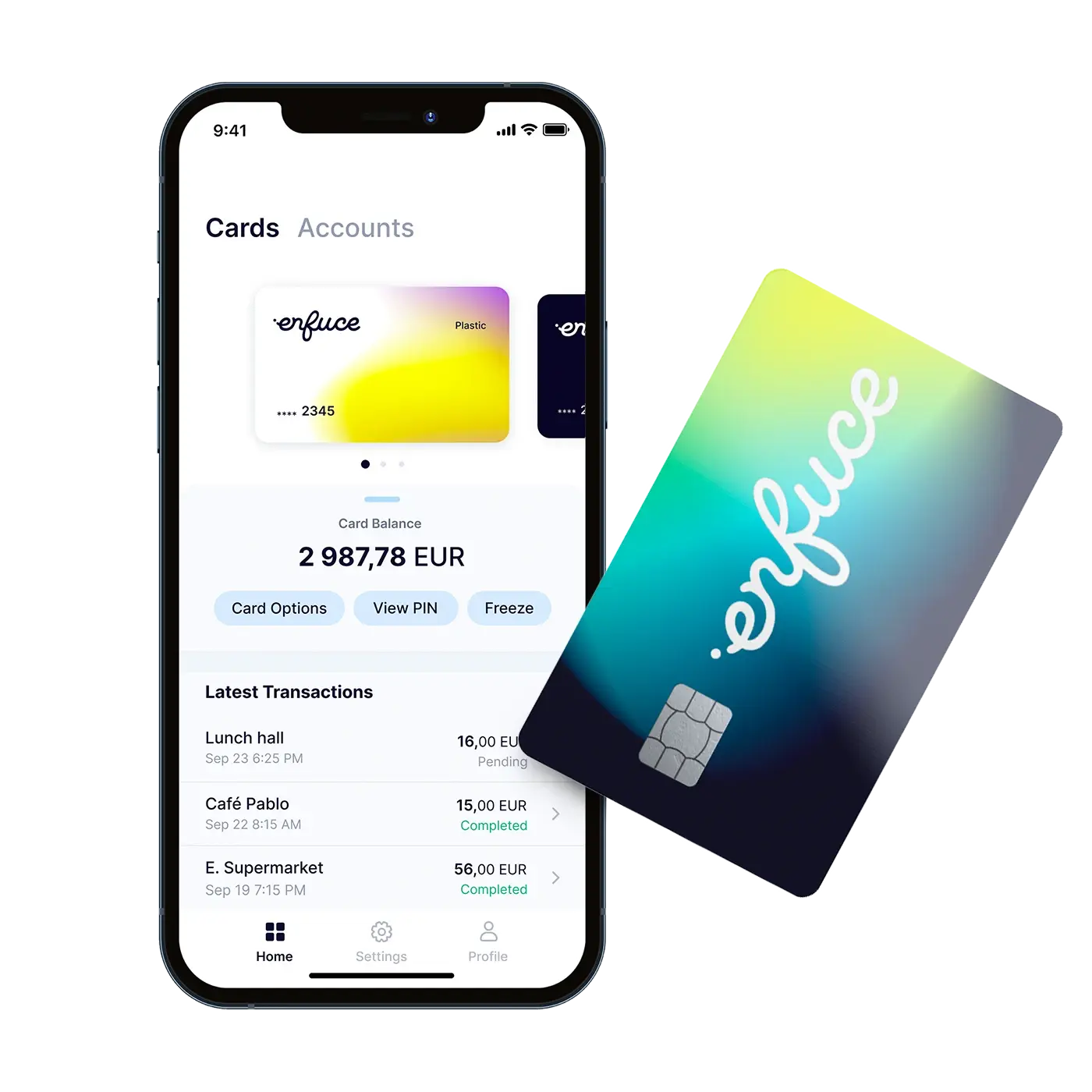

Innovative Card Issuing & Processing Made Easy

Scale your business with Enfuce’s secure, compliant card issuing platform. Enjoy fast deployment, flexible solutions, and seamless migration support to ensure your success.

How it worksRelax. We got your back

We handle every aspect of card issuing and payments processing. Allowing you to scale your transformation programmes, quickly and easily, anywhere in the world.

As strategic partners, we champion your vision, offer practical, straight-talking advice, and go the extra mile to find the right solutions. Because when you win, we win.

Modular.

Isn’t it nice to get exactly what you want and not pay for things you don’t? That’s why our platform is truly modular. It gives you the freedom to choose the optimum combination of capabilities that meet your needs, exactly.

Scalable.

We make it easy for you to scale your business and enter new markets. Our industry-leading cloud-based payments infrastructure is built to scale as your card and payment volumes grow. Simple.

Secure.

Payment processing with an exceptional 99.999% uptime. Round-the-clock fraud monitoring. Dispute management, and PCI-DSS, GDPR, and PSD2 compliance. 3D Secure authentication… the list goes on. In other words, security’s taken care of.

Cutting edge.

Card apps. Real-time data updates. Best-in-class payment processing. APIs that let you monitor card programmes, compare your performance, and share reports with important stakeholders. Who says you can have too much of a good thing?

Straightforward.

If something’s needed, we sort it. Our open, honest dialogue constructively challenges expectations and supports your strategic decision making. Fusing first-class expertise and an entrepreneurial spirit, we stop at nothing to find the best solution for you. It’s that straightforward.

Meet our network of trusted partners

Launch and grow a card programme that delivers loyalty, revenue and scale

The practical playbook for launching, scaling and future-proofing a strategic card programme. Whether you are a bank upgrading legacy systems, a fintech entering issuing, or a brand embedding financial services, this guide helps you move forward with clarity and confidence.

Download your copy