Ten best practices for a winning payments RFX

Many payment card issuers are turning to Software-as-a-Service models – quite understandably. Commissioning in-house solutions is often more cumbersome and expensive than buying a payments solution as a service. Running a solution in-house also directs resources away from your core business: building the best possible payment experience for your end-customers.

When choosing a card platform provider, the last thing you want is to spend money, time, and effort and still end up locked in with a vendor and system that don’t deliver what you need for your payments business. That is why taking a hard look at your RFP/RFI process will continue to pay back long into the future.

In this article, we share with you the best practices on SaaS RFX processes, applicable across enterprises.

By reading, you’ll learn:

- How to find a vendor that understands your needs – and grows with your business

- What kind of questions you should be asking yourself and your future vendor

- How Enfuce can help you turn your RFX daydream into a reality

1. Set your strategic goals straight

The key to a successful RFX, and to finding the best-fit solution for your business, is having a clear North Star. Here are some questions for you to get started:

- How will this solution help fulfil your strategy, mission and vision?

- What are you trying to achieve with this solution? What does it solve?

- How will it help your customers?

- What is your strategy in selecting a vendor? What are the key values you want to build the relationship on? What does a successful partnership look like for you?

This information is already documented in your strategy. At its best, buying in a modern way will bring you closer to your strategic goals. The ‘how we solve this’ should always only be a means to an end and never direct your decision making process.

2. Build the RFX dream team

Building the RFX starts from defining your business needs and the desired target state. By getting the right people involved, you will both get a comprehensive and complete RFX and gain internal buy-in for the project.

Here are some people you want input from to build a successful RFX:

- Business owner, to outline the business targets and desired use cases into requirements and vendor evaluation criteria.

- Compliance specialist, as changing the approach from building and running a complete IT solution in-house to working with SaaS vendors will need to be blessed by your compliance team.

- SaaS procurement specialist, for ensuring the process. This role can be an in-house person or an external consultant.

- Wide IT representation, for technical and information security requirements and avoiding issues in the implementation phase.

- Solution/Enterprise architect owns the vision for the system-to-be and understands the big picture. This person will have deep knowledge of both business targets and the requirements and limitations set by existing system architecture.

- Broad set of other stakeholders with focus on customer experience, such as representatives from customer service, legal, sales, and other relevant functions. These stakeholders will make sure that forming the partnership with the vendor is not just a top-down project, but takes into consideration firsthand employee and end-customer insights.

3. Introduce your business and operations

By giving a detailed overview of your company and the business you are in, your potential vendors will better understand your needs, challenges and opportunities.

Sharing actuals and forward-looking estimates on your operations (e.g. your payments solution portfolio, card programme(s), volumes, and geographic reach) will help the SaaS vendor best present their service in your context.

4. Search for a partner rather than a supplier

A supplier will deliver a solution with the requested capabilities. They will take your requirements and give you something functional. This kind of approach will require you to operate parts of your business separately or bring in a bigger pool of providers.

A partner understands your business today and where you want to be tomorrow. They will actively think along with you and give strategic guidance.

You don’t need to tell them which functionalities you want. You only need to tell them what the end state should be and they deliver the solution (tech, expertise, processes and compliance) that gets you there.

5. Build the core of your RFX from your strategic goals

Look back to best practice number 1: Setting your strategic goals straight. So, ask yourself: What are the most important goals that you want to achieve by buying a service?

Choose the business critical topics that the solution should be supporting or enabling and derive relevant questions from them. Avoid asking questions based on how things are done today with a current vendor. They are done a certain way because of limitations the existing vendor might have, or capabilities they can’t support.

These limitations should not be the frame for your future solution. Focus on what you want the ideal end state of your solution to be, not whether your current vendor would be able to achieve it.

6. Ask with purpose: Relevant functional questions only

What companies often stumble on is trying to predict every possible situation and scenario before it takes place. This leads to an overly long list of questions where high priority items get no more weight than possible future scenarios.

Many RFXs include questions that add no value. Those questions end up taking weight and essentially diluting the important questions.

Many companies think that ‘future-proofing’ your vendor means including all sorts of hypothetical scenarios that might be relevant for you at some point. Doing this will eliminate smaller vendors that might be more flexible, innovative and just what you need for your business right now.

To find the best vendor for your strategy, only include questions that apply to plans that are certain.

How do you know what is a high priority question? When writing it down, ask yourself why you want to know the answer.

Example:

- Don’t ask: Do you support issuing credit, debit, prepaid, gift and private label cards worldwide?

- Ask instead: Our target segment is young adults and we are aiming to increase our market share in our current market as well as launch in two additional markets in the next two years. We want to offer them a flexible card solution that grows with them as they enter the next stage of their lives. Key selling features for us are our user-friendly mobile application, our capability to mitigate risk for our customer base and matching end-user demands of flexible repayment options. How does your service support this business objective?

7. Ask with precision: Be specific about what is important to you

A common problem with traditional RFX questions is that they can be interpreted in multiple ways and vendors always interpret the questions in a way that is favourable to them. While it takes a bit more effort to write down exactly what you need, it will serve you in the long run.

Example:

- Don’t ask: Do you offer interest calculation?

- Ask instead: Do you offer daily interest calculation with a 365 divider?

8. Set a weighting to reflect your strategic goals

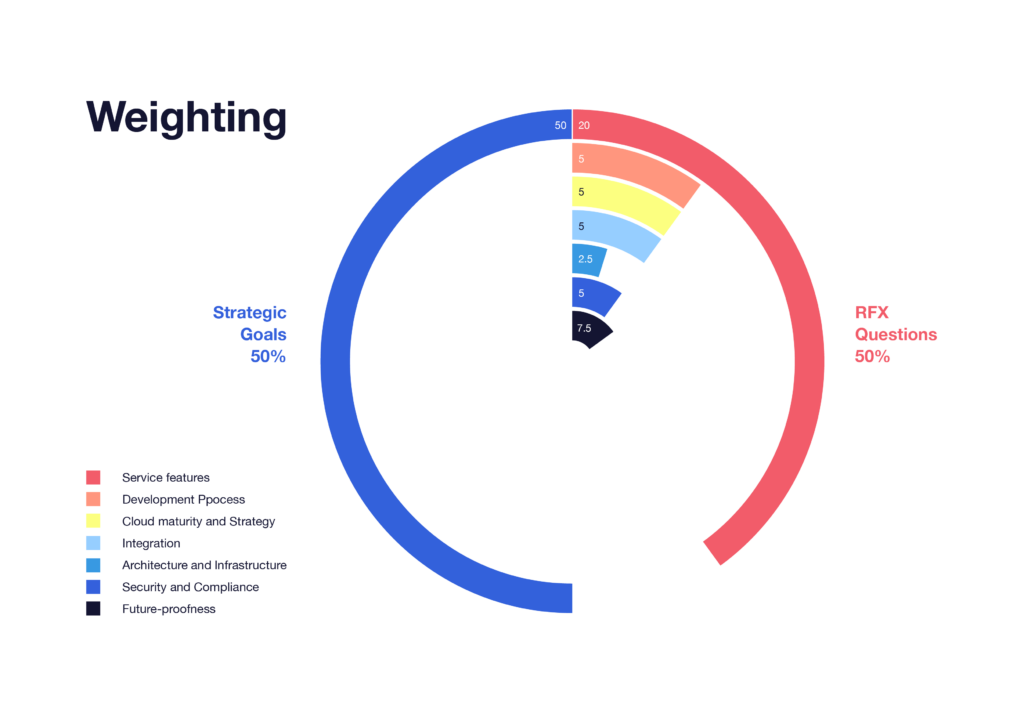

Every RFX lead should set at least half of the weight on how the solution meets your strategic goals (your ‘why’) and the rest on the solution functionality itself (your ‘how’).

Well defined strategic goals help you define the expected outcome and, eventually, set the correct metrics to validate that the outcome has been met.

9. Make continuous improvements and start small

Building a strong RFX questionnaire is a process, not a one and done thing. Evaluate and improve your template after every iteration of your RFX process to make it work better for your needs.

This applies to big migration projects as well. Don’t plan every project and every product at the same time. Start small and build trust with your vendor.

For example, build one type of card together first, implement changes first for a smaller group of loyal customers, get feedback and improve. You need a vendor who can be agile and start building day one but also has a solid track record in migrations.

10. Have an exit clause

You shouldn’t enter a partnership with the intention of ending it but sometimes unforeseen issues may surface. You don’t want to be stuck with a vendor that you are not happy with.

So make sure that you have an agreement about exit clauses, ask how you can protect your business continuity, and how costs are distributed if you need to migrate to another solution.

Get ready to create a modern RFP or RFI

Did you like what you just read? Then check out The Ultimate Guide to Payments RFX in 2022.

In this guide, we share concrete steps on building an RFX questionnaire so that you can choose a vendor that understands your needs and grows with your business.

By reading it, you’ll be equipped to create a modern RFP or RFI and discover:

- How you can optimise your RFX process and grow with the right vendor.

- The ten best practices for a winning RFX.

- How you can turn your strategic goals into RFX questions.

- How you can complement your RFX with the relevant questions on solution functionality.

Download the guide by filling in this form

And if you have any questions, please do not hesitate to contact us!