Enfuce helps Qred complement their service offering for SMEs with a credit card

Every entrepreneur is probably familiar with getting service at two different desks at the bank, as they are both a business owner and a consumer in their personal life. What is a smooth service experience as a consumer, many times ends up in a nightmare for an entrepreneur, as decisions take a lot of time and services come with additional fees. So when Qred entered the lending market for SMEs, they soon realised there is a demand for better credit cards, as well.

The day-to-day of a small business is full of micro-payments for materials, online purchases, marketing, groceries, and the like. But the entrepreneurs can’t waste time waiting for traditional banks to decide whether they are eligible for a credit card or not.

Qred wanted to provide a fast, easy, and transparent credit card solution to simplify the life for SMEs. Time is often the most valuable resource for SMEs, so speed was of the essence. And being an agile player, Qred requires swiftness and flexibility also from their partners.

To make the entrepreneurs’ lives easier, Qred decided to launch a credit card with Enfuce. With Enfuce’s Card as a Service, they were able to grant their end customers quick and easy access to a credit card.

A shared vision for solving the SMEs’ payment challenges laid the foundation for the collaboration

Just before the pandemic hit, Qred started looking for a partner within payments processing that could serve customers in many countries and respond to new development needs quickly and decisively.

Having interviewed multiple payment processors, Qred decided on Enfuce: a young, proactive and ambitious company – just like Qred – with a great cultural match and the needed product know-how. As both are challengers in their field, there was an understanding of each other’s needs and pain points.

We wanted to join forces with a processor that is the best in their core operations [payment processing], but also understands our challenges and can help us overcome them. It was crucial that we both have a shared ambitious vision for the future where SMEs deserve better payment and credit services than they currently get from traditional banks.

Thomas Jansson, the Chief Growth Officer at Qred.

Making payments simple yet understandable

Clear communication has been an important part of the Qred – Enfuce collaboration. Enfuce speaks about payment infrastructures and processing in a professional yet understandable manner.

People who are not experts in this field can then stay up to date, make informed decisions, and fully participate in the joint development.

Unlike many other processors, Enfuce has been able to filter out all the payments-related jargon and present the solutions in simple terms. One of our key-values is Transparency and we are always working towards making financing as accessible as possible for our customers.

Thomas Jansson

The credit card product broadens Qred’s service portfolio

The card solution has since its launch in August 2021 become an integral part of Qred’s offering for the SME segment, allowing entrepreneurs to save time and money with smoother payments. The card itself is free to the users and using it doesn’t create additional charges.

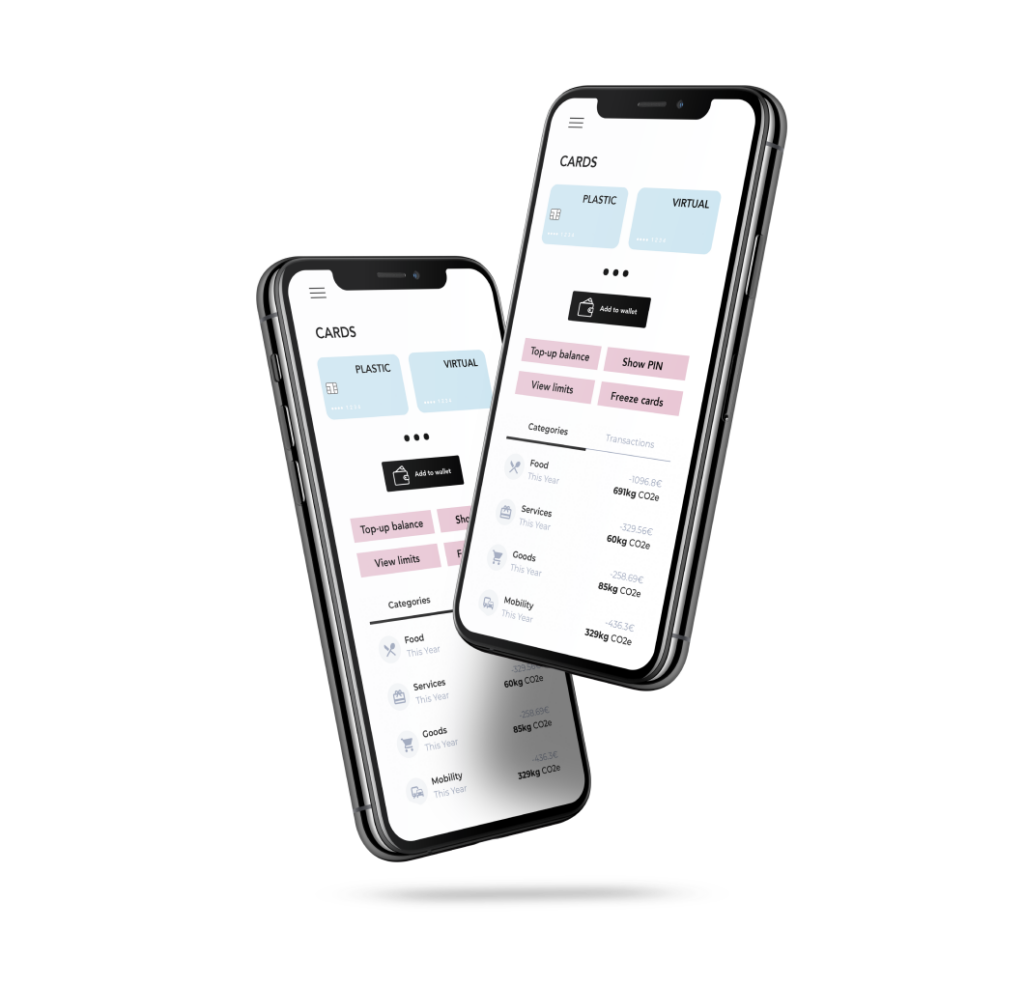

The card product consists of a credit card and a supporting digital app. Using the app allows you to stay on top of your purchases, balances, and card details (including PIN) in real time.

Simplicity is key for Qred’s customer experience. Ease of use was the main criterion for the card design, but the setup also enables customisation for digitally advanced uses.

Since Enfuce understands Qred’s business and the SME customers’ challenges, they are able to offer a card solution that addresses the entrepreneurs’ needs in a personal, understandable and relatable way.

Smooth and fast implementation ensured swift access to the card product for Qred’s customers

With Enfuce’s help, Qred was able to launch the solution in a matter of months rather than years. The technical onboarding only took four months, including a short break during summer. This ensured that Qred’s customers had prompt access to credit cards.

This was made possible with quick decisions, easy interpersonal communication, shared ambition, and syncing timelines with multiple players. The partnership has been solution-oriented to the core.

When you come up with a new idea for the product, all that is needed is a phone call to the project manager, and you’ll soon know what can be done, how, and when.

Thomas Jansson

Expanding across Europe with Enfuce’s Card as a Service

From the beginning, Qred’s aim was to provide better service for the target audience in an internationally scalable way. Having started card issuing on the Swedish market in August 2021 and then expanding to the Finnish market in February 2022, Qred’s next step is to continue expanding to new markets.

The internationally scalable card offering and its multi-country setup are an integral part of Qred’s expansion plan. There are still many markets where small businesses are lacking proper payment and credit services. With the help of Enfuce, Qred can ease the SMEs’ day-to-day operations by providing a solution best suited to their needs.

New relevant features will also help Qred serve their customers better. Recently, Qred launched an invoice payment solution allowing SMEs to pay off purchase invoices in a few clicks using the Qred VISA. Additionally, the card now comes with a cashback reward programme: the card will not only be free, but the user can earn money by using it for their business purchases.

We have an ambitious agenda with new features to be released to our card holders in the future, and best of all, it’s driven by what our customers want. Whenever we add features, it must be something that brings value to our end users.

Thomas Jansson