Why launch a payment card for your customers?

Consumers of today expect magic from their payment experiences. Inspired by tech giants such as Amazon and Netflix, people want their payments to be fun and effortless – but so do businesses. A modern payment card makes this possible, letting them use, move and understand money in completely new ways.

By reading this blog, you’ll learn:

- Why you should launch your own payment card offering for your customers

- Why it is easier than ever before to launch your own payment card

- What capabilities today’s payment cards have

Modern payment cards have changed the financial landscape

Payment cards used to be rather static, single-purpose commodities issued by retail banks. Today, however, the magic of seamless payments can be seen everywhere from e-commerce sites to music services, investment apps and brick-and-mortar stores. With the rise of fintechs, payment cards have taken a positively disruptive role in the financial ecosystem. As a result, it is the key touchpoint to smarter financial services.

This does not apply just to consumers but businesses as well. They increasingly demand the same convenience and ease of use from their payments as consumers. Modern payment cards give them new ways to manage spending, increase employee satisfaction, and save time by integrating payments with their accounting software.

Payment cards enable scaling globally and increase customer loyalty

Across the financial industry, modern payment cards have expanded opportunities to monetise payments, expand services and differentiate brands. With an active user base, card data can reveal key insights on your customers’ behaviour, for instance. Based on this data, you can offer your customers more personalised services and increase customer engagement.

There are a few examples of this from the financial world. Neobanks like Monzo and Revolut have propelled their transaction banking propositions with payment card offerings. This has helped turn trial users into loyal and engaged customers.

In the fast-growing financing and lending space, global card issuing can underpin instant value-adding features. These include giving access to payment cards and receiving funds in just minutes, for instance.

Launching your own payment card is easier than ever before

The payment card industry is changing rapidly. Are you aiming to launch your own payment card offering? If yes, there are a few things that you need to know to easily unlock all the possibilities that payment cards have to offer.

- Cloud and mobile technology: Largely thanks to advances in technology as well as modern and dedicated card service partners, you can design, launch and scale tailored card offerings.

- Turnkey card services: Service providers who have adapted their systems and mindsets to the digital era have bundled together the essentials of seamless card issuing into a turnkey solution. This makes it easier for you to launch, run and develop card products.

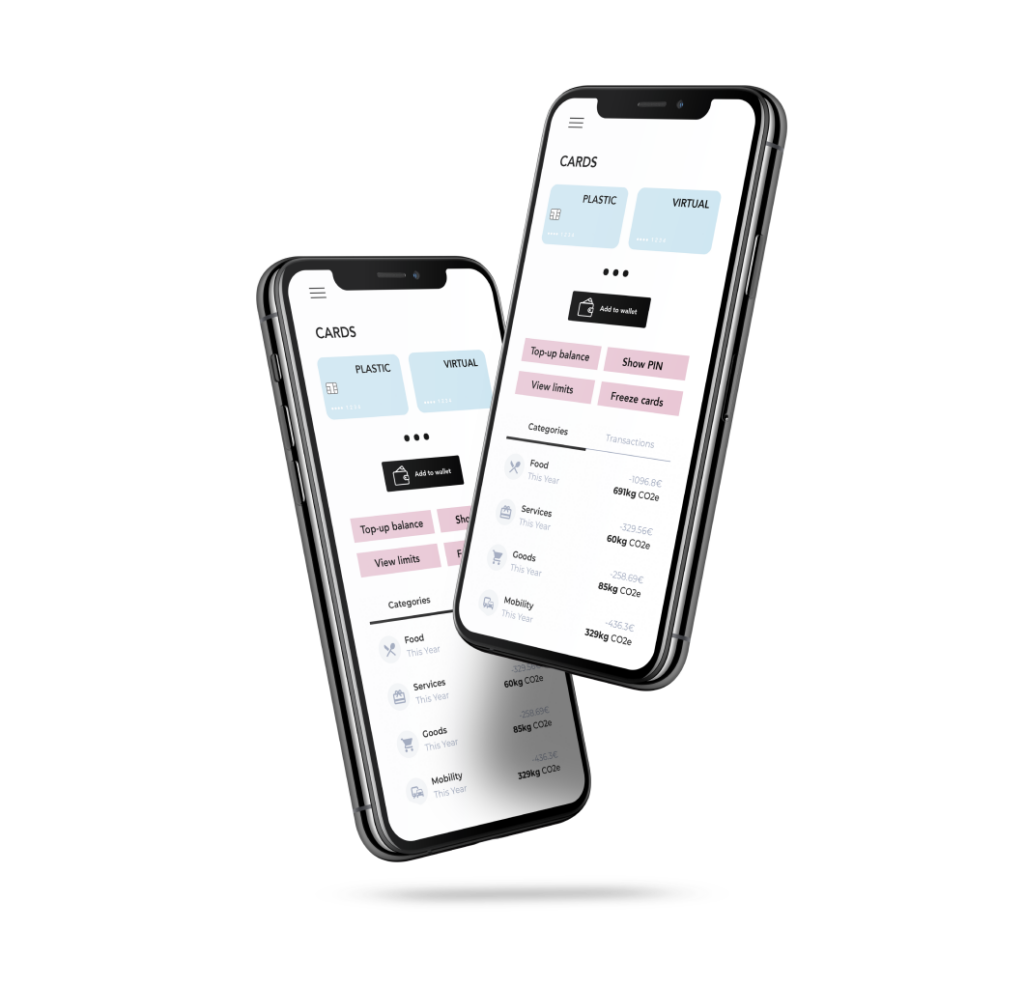

- Flexibility of modern payment cards: Card service partners ensure that your card solution will keep pace as your customers’ needs evolve. Modern payment cards come in many different types and forms but are also flexible in terms of geographical reach. Plus, features and payment channels can be added as you move along.

The possibilities of modern payment cards are endless

Before you start defining and designing your card product, you should be aware of the tools and possibilities of modern payment cards:

Dynamic spending controls: It’s possible to automatically prevent card users from paying more than a set amount. This increases security through limiting unexpected cardholder behaviour.

Card features tailored to niche audiences: For example, parents can safely introduce their kids to payment cards using spending controls. These limit the usage of the card to for instance specific merchant categories.

Virtual payment cards: Enable users to make online payments in just minutes after applying for the payment card.

Add-on payment features: Digital wallets such as Google Pay, Apple Pay and Samsung Pay further increase the usage of your services.

Integrations to omnichannel commerce experiences: You can create a uniform commerce experience for your cardholders in mobile, web and brick and mortar stores.

Want to design the ideal payment card solution for your business? Our comprehensive guide has everything you need to know to launch the winning payment card product. Download now