Why lending and credit fintechs should issue payment cards for their customers

The lending industry is affected by several external and internal forces. The COVID-19 pandemic has caused economic instability across continents, impacting consumer and SMEs’ consumption ability and choices, and thus their demand for unsecured loans. Moreover, it has driven further digitalisation of lending services, customer onboarding, and KYC processes even for the more traditional lending providers.

In Europe, increasing regulations such as the interest cap introduced in some countries limits the revenue streams accessible for lenders. Lending companies are seeking new ways to protect the existing loan base and agreements from stricter regulation, while forming new offerings that are competitive in the changing business environment.

By reading this blog, you’ll learn:

- Why customer experience is one of the key differentiators for lending and credit fintechs

- Why cards drive customer loyalty and engagement

- How to give your lending and credit customers easy access to credit

1. Competition is fierce – best rates and service experience win

Emerging fintechs are disrupting the field of consumer and SME lending through advanced technology, such as AI-based scoring mechanisms and applications relying on open banking. Differentiating UIs and a smooth digital onboarding experience are also helping emerging fintechs to disrupt lending and credit. As digital natives, lending and credit fintechs often have superior operational efficiency in comparison to traditional players. They are higher capabilities to scale, they have less legacy in their systems and a smaller overhead compared to established lending providers.

Providing customers a fast access to funds is a competitive challenge that both SME and consumer lenders need to solve. SME lending customers are often underserved by established banks and need to access the funds quickly for everyday operational needs, cash management, and business-critical spending. The speed of accessing funds and an adequate positioning in merchant channels are key in the customer experience and help the best lending and credit providers to differentiate from the competition. This is especially true for consumers who are often more impulse-driven. Both today’s SME and B2C customers can compare lending options well online – either directly or through aggregator services.

Thus, lending providers need to acquire new customers in the fiercely-competitive environment while maintaining loyalty within the existing customer and contract base. Aside from competitive loan rates, a streamlined onboarding user experience with a minimum number of steps and the capability to provide an instant access to funds are important in lending and credit offering. Existing customer base can be maintained by an attractive offering for returning customers and introducing engaging digital add-on features.

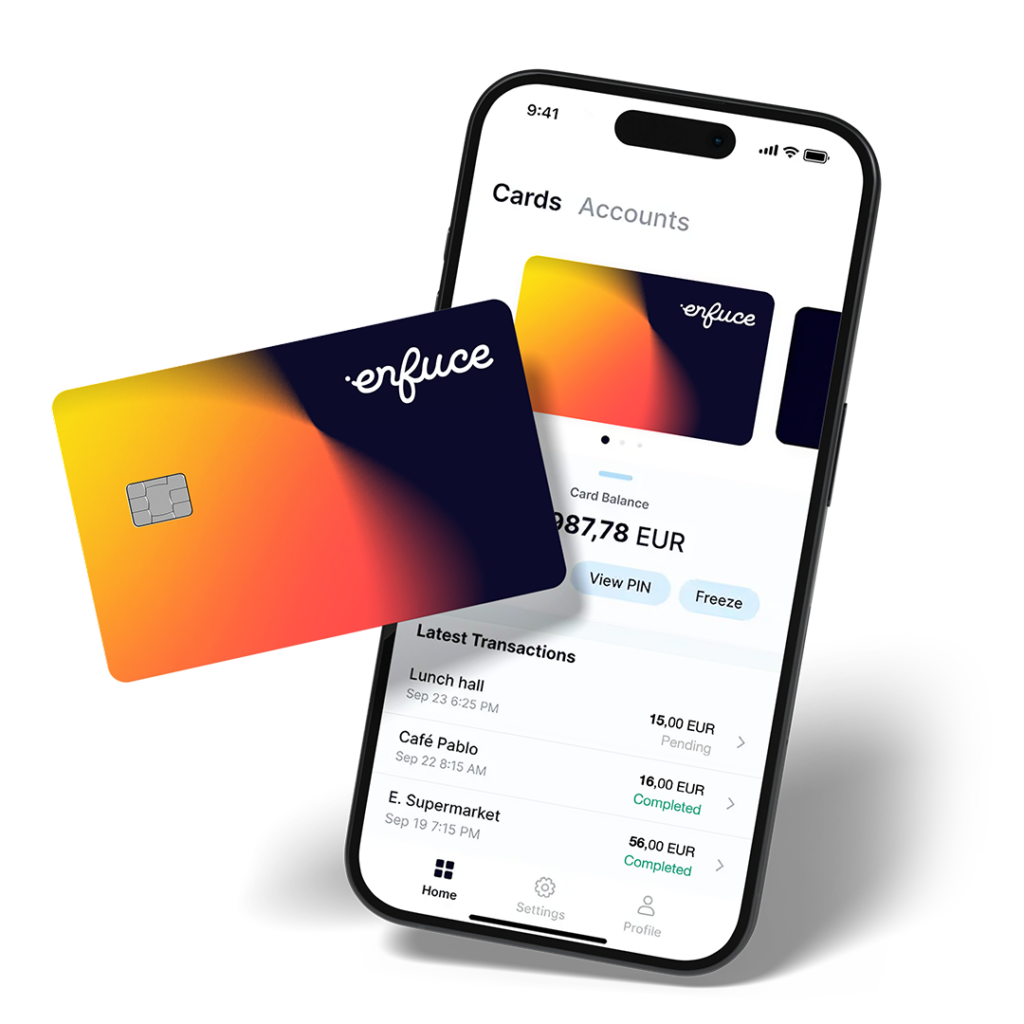

2. Payment cards drive retention and provide faster and easier access to credit

As an extension to loan portfolio, payment cards can support instant funding, smooth access to credit, and increased loyalty for both consumer and SME customers. Card transactions operated in global payment networks are available in real time and standard form for any region and receiver. Also, issuing payment cards for business or consumer customers replaces the need for account transfers in accessing the credit. This reduces both steps required from the credit issuer and the user but also reduces possible delays through bank days required for the money transfer. Virtual cards are already an industry standard, and they enable the lending customer to start using the credit for online payments in minutes after the application process is completed.

A card offering can also drive customer loyalty and engagement as well as increase the barrier of switching to another provider. As cardholders, customers are more probable to renew their loans or use other lending products from the same vendor. By introducing a business card and value-adding payments or expense management features, lending companies can motivate SME customers to focus on one loans provider. In the case of peer-to-peer lending, introducing cards also drives growth of the investment base, as cards provide an attractive and effortless access to profits.

A card offering can also drive customer loyalty and engagement as well as increase the barrier of switching to another provider.

3. Lending and credit providers can launch their payment card

Today’s cloud-based card issuing and processing services allow lending providers to design a card solution that supports their business goals and existing architecture. Cards can be either connected to existing loan balances or linked to a separate credit account handling a branded credit card used for specific card transactions. Third option is a prepaid account which is topped up based on the available credit. In practice, the lender tops up a prepaid card from the credit line, making funds available at the card account in real time.

Enabling dynamic spend controls lowers the risk level and increases the configurability of the card solution. For instance, it prevents the user from exceeding the credited amount. Additionally, cards can be authorised for only certain transactions with specific merchants or merchant category codes.

As an add-on offering, payment cards are relatively easy to launch for a lending provider. In many cases, the required card issuing enablers – a credit line, a mobile and/or web application, and potentially an e-money license – are already in place. Remaining enablers such as scheme memberships are offered at a reasonable lead time and cost by partners. Thus, it is possible to launch, for instance, a combination of a prepaid card with the existing credit line for the first geographical market. Cards enable fast and easy new market entries, and business expansion through new payments features.

Adding cards to your portfolio enables packaging different credit products into flexible financing offerings and allows the lending provider to increase insight into credit usage. Add-on payments features such as digital wallets (Apple Pay, Google Pay) , instalments, and revolving credit features enable lending providers to further increase the customer wallet share and application usage. Finally, for some lending and credit fintechs, introducing cards may be the first step of business expansion towards becoming a full digital bank or asset manager.

Our payment experts are happy to support you in taking your business to next level. Just reach out to us and we will be in touch!