Enfuce Payment Services

Scale your business through payment services that your customers can trust and love.

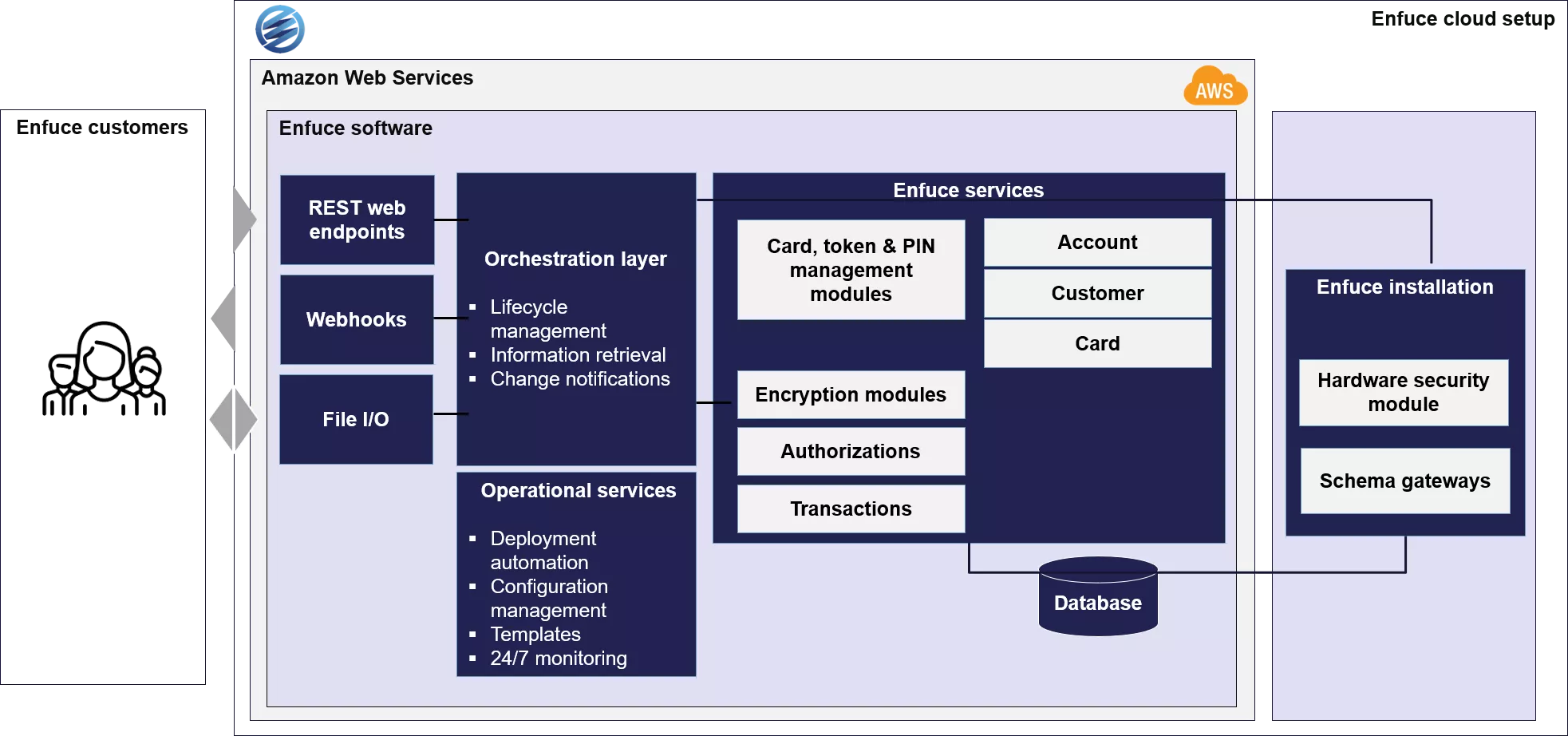

Enfuce next-level card issuing and payment processing services – powered by Amazon Web Services

Enfuce was globally the first provider to put payment processing into the public cloud in 2016. With a cloud-based solution we lower the time to market for new functionalities and products for our customers.

We found the best compatibility for our solutions in Amazon Web Services. The AWS public cloud service operates on a global scale, with every imaginable type of business using it. This requires the provider to be on a top level in both reliability and security giving us and our customers peace of mind when it comes to functionality. Today, Enfuce is a trusted card issuing partner of many European financial institutions, fintechs and other growth-minded companies. Our experienced payments and compliance professionals employ the latest technology and market insights to provide flexible solutions for card issuing, payments processing and digital payments.

Card issuing and Payment processing as a service

- Instant cardholder onboarding and issuance of cards and tokens

- BIN Sponsorship & Programme Management

- Direct integration with Visa & Mastercard

- Payments processing

- Card lifecycle management

- Fraud monitoring and dispute management

- KYC & KYB processes for all EEA markets

Complete Payments Portfolio

Our comprehensive payments portfolio consists of both physical and virtual payment cards as well as digital wallets.

- B2B & B2C prepaid cards, debit cards, credit cards, gift cards, loyalty cards, or fleet cards

- Full digital card features

- Apple Pay, Google Pay and Samsung Pay

Success with Payment Services

Since 2016, we’ve built easy-to-use, safe and scalable payment solutions that our customers and your end-users worldwide can trust and love. Check out what our customers think about working with us!

WHY ENFUCE?

This is how we do it

Our experienced payments and compliance professionals employ the latest technology and market insights to provide a leading turnkey issuing service – tailored to your target market and flexible in terms of software architecture, feature add-ons, and Europe-wide geographical reach.

Fast go-to-market

Launch rapidly through streamlined processes with partners and instantly onboard users through the fully mobile process.

Tech, People & Processes

Reach stellar customer experience by combining Enfuce state-of-the-art tech and deep industry expertise.

Security & Compliance in our DNA

Ensure your business is always up to speed and compliant with the changing regulatory environment.

Scale & Growth

Take your business to the next level. We help you to open new markets, increase volumes, and unlock new features.

Enfuce Cloud Service Architecture

Learn more“A key benefit of using AWS is the compliance support, which is amazing. Just being in the AWS Cloud, where those critical compliance assessments are already done, is a great benefit and a timesaver when we talk to our Qualified Security Assessor, who makes our PCI DSS compliance assessment.”

Niklas Apellund, Co-Founder and VP Engineering at Enfuce

OUR OTHER SERVICES

Value-adding services

We also develop value-adding sustainability and open banking services that benefit people, banks and businesses. Whether you’re looking for future-proof compliance, streamline your existing processes, or offer user-friendly solutions to your customers and end-users, we’re here to help you succeed.

Open Banking Services

Maximize the potential of PSD2 and open banking.

We help banks, fintechs and financial institutions become and remain fully PSD2 compliant, and get access to digital accounts.