Smiling yet? Hopefully, you soon will be

Start from scratch or take your existing programme to the next level. We’ll help you create card programmes that inspire customer loyalty and competitor jealousy. Sweet.

Discover how. Contact usYou. Us. The start of something big?

When something needs doing, we do it. We care as much as you do, possibly more, about finding and executing the right solution.

Successful card programmes are more than just modern, fast, secure technology. They take the right people and processes too. Luckily, we’ve got that. As well as everything you need to feel calm about compliance, so you can focus on running your business.

Build the payment programme you need.

We handle every aspect of issuing and processing, and our modern modular tech enables you to build exactly what you want and need. A flexible approach that's designed for speed and scalability. Try out the Cardbuilder to discover your happy place!

Customise your card programme.

Let’s make your payments cards…

Flexible.

With our modular range of features and services, you simply pick and choose the bits you want to make up your ideal payment solution. Of course, our team will be on hand to guide you through it, but the power is in your hands.

Scalable.

Our cloud-based solution is what we’re known for. We’ll skip the details of it and get to the benefit: It means you can scale your business globally without costs. Perfect.

Safe.

Often, our customers don’t even notice how secure and compliant our solution is. That’s how we like it. Because it means it’s working. There’s 99.99% uptime, 24/7 fraud monitoring, dispute management, and much more.

The essentials

BIN Sponsorship

When we say one stop shop, we mean it. If needed, Enfuce can equip you with all the licensing you need to run a card programme.

Enfuce BIN sponsorship includes two crucial components: an Electronic Money Institution licence and a scheme membership with Visa or Mastercard.

Our EMI licence has been passported across the EEA. We are regulated by the rigorous FIN-FSA and support all BIN types.

You can benefit from our strong partnerships and experience working together with card schemes.

Issue any card type

We do it all. Physical or virtual, Mastercard or Visa, corporate or consumer, open loop or closed loop, credit, debit, charge card or revolving credit, even disposable. Of course tokenized.

Credit solution

We can design a solution that allows you to tap into credit card revenue streams, without dealing with the complexity. It can be as turnkey as you need.

The control you want

Card management APIs

A great cardholder experience is at the centre of what we do. This includes giving cardholders the ability to manage their cards themselves. Features like view PIN, card freezing, and geoblocking are available through our robust APIs so you can include them in your apps. All while keeping you out of PCI scope, as we take the work out of compliance.

Advanced spend control

Enfuce’s flexible spend controls limit your exposure to risk and fraud, while keeping you in the driver’s seat.

Control when, where and how payment cards are used on a granular level. Set limits on card usage based on budget, counters, or merchant category codes, for example, with Enfuce Spend Control. If you want to further enrich spend controls, you can create rules for approving and declining payments in real time with Authorisation Control.

Card programme insights

You need to stay on the pulse of everything your card programme is delivering. No problem! Enfuce provides card base, account and transaction insights in three forms. Raw data through APIs in real time, daily data warehouse files, and business insights from your card programme through the MyEnfuce portal. So you’re all set when it comes to tracking and forecasting card programme performance.

Digital first experience

Let’s face it. Customers now expect digital-first experiences from payment providers and banks.

What does this look like? It’s a smooth onboarding flow in-app or online. It’s instant issuing for both virtual and physical cards, and being able to immediately add cards to digital wallets like Apple Pay and Google Pay. It’s being able to self-service in-app. It can even be personalised and relevant interactions (at scale).

Implement your desired all-digital card experience and enrich your physical card with digital first features – all possible with Enfuce.

Flexible ledger

One of this industry’s worst kept secrets is that payment ledgers can be a pain. They’re complex to build and maintain. They must be a secure, reliable, and compliant record of all your accounts, balances and transactions. If you’re issuing credit cards, there’s even more to track from interest calculations to payment priorities.

Enfuce’s flexible ledger is one of our standout capabilities, saving customers time and resources which they can devote to developing other parts of their product.

Peace of mind

Global compliance

Compliance is a topic close to our hearts. We invest heavily in compliance and security to ensure that your card programme remains compliant now and in the future.

Our experts follow the evolving regulations and we invest in training and certifications, so you don’t need to.

This means you can focus on growing your core business whilst we take care of compliance, reporting and APIs for you. Enfuce will handle PCI DSS, GDPR, PSD2 (including open banking, third-party provider (TPP) validation, and consent management), and card scheme compliance for you.

3D Secure

3D Secure is a security protocol that’s standardised by the card schemes, so you would think it’s routine to implement. But when it comes to 3DS, one size does not fit all. As online paying is growing in popularity, the importance of getting this two-step authentication process right is growing.

At Enfuce we tailor the 3DS process to align with local expectations and fit smoothly into the checkout process. It’s designed to combat fraud and protect your customers whilst meeting Europe’s SCA regulatory requirements.

Fraud monitoring

Fraud monitoring is both an art and a science. It’s about keeping up with the intricacies of ever-evolving fraud trends and building systems to detect fraud attempts and minimise losses.

Our rules-based monitoring engine is updated by our team of experts whenever needed (often several times a day). That’s 24/7 monitoring making sure your fraud ratio is the lowest possible.

Fraud management

Our fraud fighting efforts don’t end with monitoring transactions, we offer a fully managed fraud service.

By outsourcing to us, you won’t need any fraud or dispute specialists, training, or processes in place in-house. Our fraud prevention system runs 24/7 and in addition to monitoring you’ll get portfolio analysis, fraud reporting and highly-skilled second-line support.

We’re there for you and your cardholders. You’re in safe hands, because we are award-winning and exceptional in this space.

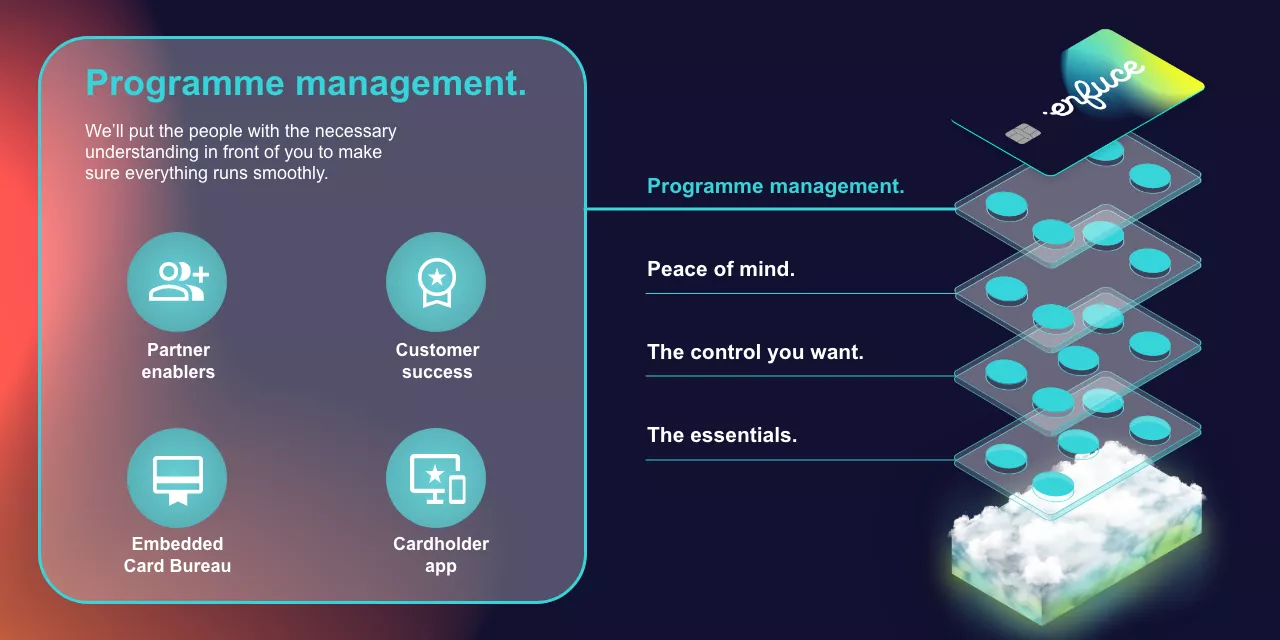

Programme management

Partner enablers

We’ve seen from experience that winning payment products combine best-in-class providers in innovative ways. That’s why we’ve screened and pre-qualified industry-leading partners to complement your core card product.

Whether it’s embossing houses for physical card production, KYC providers for customer onboarding, FX providers to support multi-currency operations, core banking operators to bring in virtual IBANs, or all of the above.

We worked closely with several trusted partners and can help you determine the best solution to meet your business goals and cardholder needs, and get to market quickly. If needed, we can even manage many of these partnerships for you.

Customer success

Enfuce customer success goes beyond what you would expect. We start with solution mapping (and migration planning) at the beginning of our partnership. We can orchestrate many of the third parties involved in getting your card product live. We’re there as your strategic partner to make sure you integrate to our platform smoothly and swiftly.

Post go-live, your CSM will set up a regular meeting cadence to keep you updated on product roadmaps, gather your feedback and make plans for further developing your payment offering.

Embedded Card Bureau

Enfuce has your back when it comes to physical card production. Whatever card product you want to create, we’ve got options. We’re already integrated with several card bureaus and we’re flexible in working with new ones.

If you want to launch quickly, no problem, you can leverage our MyCard solution – pre-approved card designs and existing partner network. We can even fully manage the embossing house contract and relationship for you.

Cardholder app

We call it MyApp and it can be yours too. It’s a ready-to-launch card management mobile app for your customers.

You’ll find everything you would expect from a modern card management app – simple, quick, easy control over cards, real-time transactions, and safety built in. Better still, it’s all maintained by Enfuce which means you can avoid the costs and challenges of building your own app. And it’s always bang up-to-date and secure.

And this is how it works

-

Solution design

- Creative workshops where you chat with our experts

- This leads to us defining your perfect card solution

-

Onboarding

- Product configuration

- Required enablers

- UI and app design

-

Launch

- Street pilot and initial user feedback

- Launch your card (yay!)

-

Scaling and evolution

- Enter new markets (yay!)

- Grow your userbase (yay!)

- Continuous user analytics (yay!)

- Unlock new features (yay!)