Problem: Children and other less financially savvy groups can only gain independence by using money and learning about the value of it. But it can be daunting to give them access to cash or a card because there is no way of controlling how they spend the money.

Solution: A card designed with advanced controls that allow the guardian to manage account top ups and set limits to where, when, and how the money can be used. The card will not work unless the transaction is authorised by the guardian with pre-set spend controls. The money will never fall into the wrong hands and the card user will learn essential money skills in a controlled environment.

Key features

Spend Control

Build sophisticated real-time controls to limit payments to certain places, times, sums, or merchant categories.

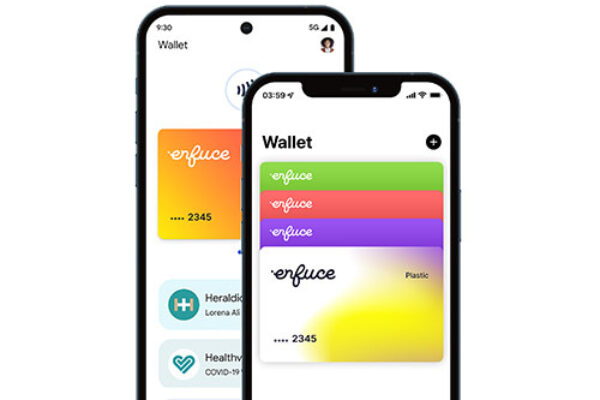

Digital wallets

Offer your customers the option to embed a digital payment card to wearables like watches and phones instead of using a traditional physical card.

Fraud prevention

Fully managed and real-time fraud control makes sure that the money stays in the right hands.