The future of payments: What will the payments world look like

How will the COVID-19 pandemic or the emergence of new systems shape the future of payments? The Co-Founder and CEO of Enfuce, Monika Liikamaa, shares her insights on the increasingly demanding customer expectations and payment trends to look out for.

By reading this blog you’ll learn:

- What kind of expectations customers will have for payment cards

- Which trends will define payments in the future

What customers expect from payments now and in the future?

Few people actually enjoy paying – it is buying that is at the core of the customer experience. Regardless, successful payment experiences are possible with flexible, safe and relevant solutions. Consumers and businesses alike have high expectations for their payments today.

Consumer expectations: payments anywhere and anytime

Consumers want their payments to be fun and effortless. Modern payment cards let them use, move and understand money in completely new ways. Payments need to be safe and intuitive – nobody should have to browse through instructions or handbooks to understand them. Consumers also expect to be able to pay whenever and wherever: in shops, on the bus and in online stores.

Business customer expectations: convenient payments without compromising compliance

Businesses also demand convenience, safety and ease of use from their payments. Modern payment cards provide new ways to manage spending and increase employee satisfaction. Integrating payments with accounting software helps save time. Like consumers, businesses expect real-time payments regardless of time and location.

In the future, more business clients will expect payments without receipts. They expect to get the data they need for accounting, cash management and reporting without manual extra steps. This enables flexibility and a smoother customer experience without compromising compliance with regulatory requirements. As a result, new companies specialising in e-receipts have emerged.

Hybrid customer expectations: run all payments with one card

Some banks consider business and consumer customers strictly separate. In reality, a single customer may be both a business customer and a consumer customer in the same bank at the same time. This is often the case with freelancers with several sources of income. Problems may arise if this kind of “hybrid customer” is required to have two or more cards in the same bank.

Hybrid customers will expect even more frictionless, intuitive and simple payments. They may wish to be able to run everything with only one service, one card, and a single identification. This brings us to our next topic.

Payment trends for 2025

Payments keep evolving along with the demanding customer expectations. Additionally, the COVID-19 pandemic has affected customer behaviors and preferences. Here are some new phenomena to look out for.

Super-Apps to meet hybrid customer expectations

Hybrid customers may wish to combine their needs as a business and consumer customer under a single payment card. As a result, “Super-Apps” like WeChat have emerged, with the user at the core of their service. Sign-ins and identifications are streamlined to make transactions and the user experience smoother. Only a few Super-Apps exist at the moment but more may emerge in the future. A strong user base under harmonized regulation might be needed, but the technological capabilities for such a solution exist already.

Contactless payment and biometrics

Contactless payments for small purchases have been mainstream in payments for a while. The COVID-19 pandemic has increased customers’ interest in them also for high-value purchases. This means that new safety features may be needed. Instead of PIN codes, customers might expect identification alternatives without physical contact. Strong identification through biometrics, such as Face ID or fingerprints, could be a solution.

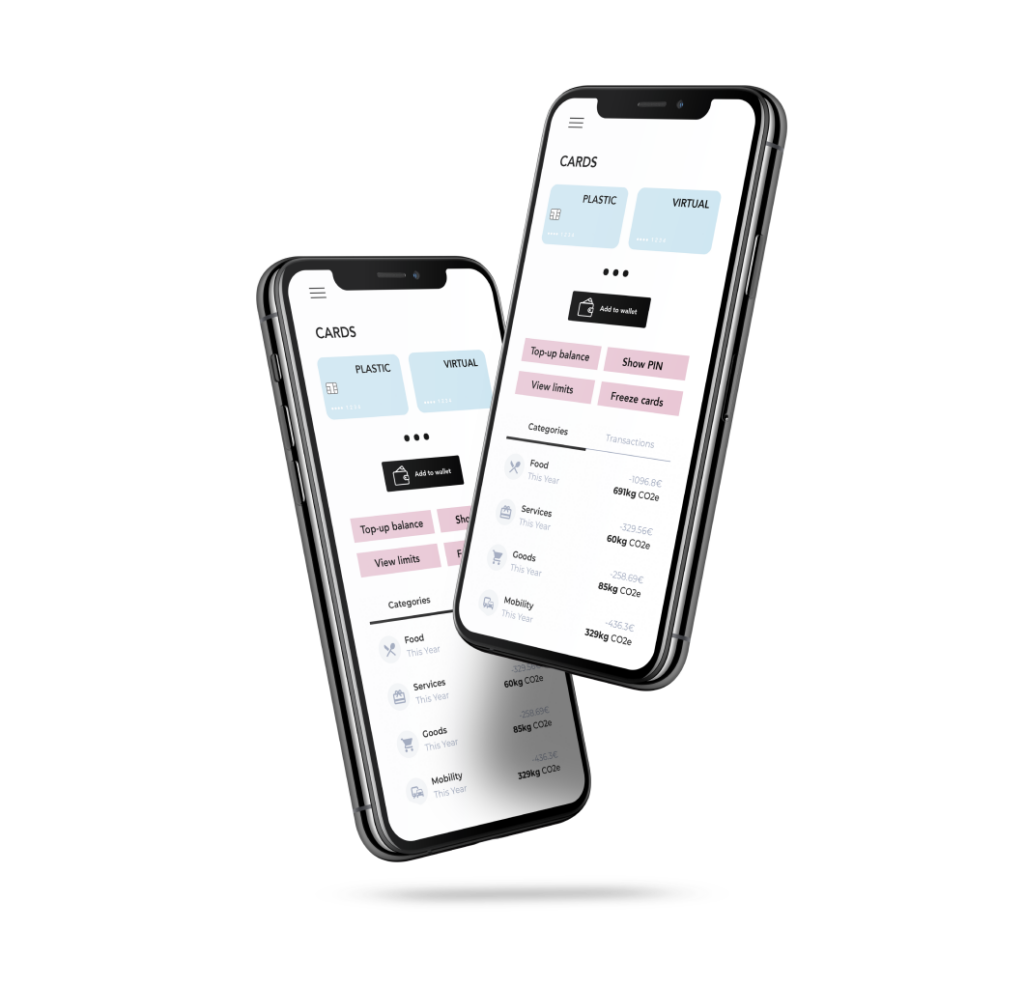

Tokenised payments expand

Virtual cards and contactless payments through digital wallets will expand into new domains. Such areas could be home deliveries and subscription-based transport and mobility services. Issuers should take these developments into account in their service design. This could mean catering for multimodal subscriptions and ‘pay-as-you-go’ services. Tokenisation will help create better customer experiences for hybrid customers in the future.

“Buy now pay later” and point-of-sale lending will disrupt credit cards

Thanks to emerging fintech players, various credit solutions have become available everywhere. Some of them are built seamlessly into the e-commerce buying journey. Aspiring issuers should assess if such add-on services are in demand among their customers. This helps them ensure that their platform can be configured for them. “Buy now pay later” payments for example may become a normal feature for payment terminals. Some new safety features and regulations may then help prevent increased indebtedness. This will guarantee a safe and pleasant user experience.

Through Enfuce Card as a Service, you’ll get access to the newest digital payments features that we’ve been building since becoming the first payment processor in public cloud, running on AWS.

Innovation in closed-loop processing

This phenomenon has made big tech companies like Facebook, Apple and Google expand their payments offering. Besides consumer-facing wallets, like Apple Pay, they now acquire services aimed at merchants. For example, Mobewee by Apple provides point-of-sale (POS) solutions. They enable app-based contactless payments that do not require additional payment hardware. You can build compatibility for these new payment methods where possible. This helps you stay relevant in the future.

The emergence of Chinese payment ecosystems

Such payment systems include players like Alipay and WeChat Pay. They are increasingly integrated into global payment schemes and embedded eCommerce application ecosystem. European processors will see them as more salient when it comes to global e-commerce and money transfer capabilities. WeChat is also one of the few existing Super-Apps with over 1.2 billion users.

Beyond card payments – open banking

Card transactions have traditionally been the dominant payment method. For a long time, they have been the only option for global, real-time and cross-border transactions. Recently, open banking has opened up new avenues for top-ups and account-to-account payments. Issuers need to be flexible and enable consumers to choose the best payment methods.

Increasing human mobility

This phenomenon might fundamentally change payments in the future. EU directives are promoting higher mobility between member countries. The demand for foreign workforce is increasing in many countries. Mobility within countries is also changing in unexpected ways due to the pandemic. Many people are moving away from cities and working from summer houses due to the remote work possibilities. As part of the “new normal”, the increased human mobility sets requirements for the mobility of payments as well – money should follow people, not the other way around.

If you have any questions about payments, please do not hesitate to contact us. Our experts are happy to support you in taking your business to the next level. We will help you meet even the most demanding customer expectations – now and in the future!

Want to design the ideal payment card solution for your business? Our comprehensive guide has everything you need to know to launch the winning payment card product. Download down below.