Address verification service

The card schemes’ address verification service allows card-not-present merchants to check the cardholder’s billing address with the card issuer to increase security and protect against fraud. The service is predominantly used in the US, Canada and UK and it is mandatory for issuers in these regions to support it. Note that the card schemes charge you a small fee for each address verification.

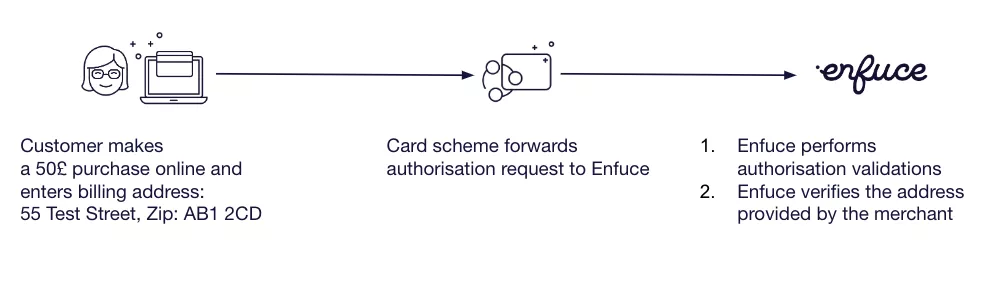

The address verification request is initiated by the merchant and can be transmitted as part of an authorisation request, account verification or a merchant tokenisation request.

The address verification request includes the billing address provided by the cardholder to the merchant (street address, and zip or postal code). Enfuce checks the transmitted address information against the address information in our database and provides a result code to the merchant, indicating whether the address given by the cardholder is a match or not.

Verification process

The verification is done against the address that is set via the ‘Create customer’ or ‘Update customer’ API endpoints. You’re responsible for ensuring that each customer has a valid address set. The street address and zip code provided by the merchant are verified against the street address and zip code captured via the Customer API.

There are differing practices in what data merchants provide and how the verification is done:

- Addresses from US merchants are fully verified, meaning that the complete street address and zip code are verified. It should be noted that the verification is case-sensitive and considers upper- and lowercase characters separately.

- Verification of addresses from UK merchants is limited to numerical values. This means that only the numerical values from the street address and zip code are verified.

After the verification is performed, the authorisation response will include the results of the address verification. There our four alternative outcomes:

- Both zip code and street address match

- Example:

- Merchant provided data: 55 Test Street, AB1 2CD

- Address data at Enfuce: 55 Test Street, AB1 2CD

- Example:

- The zip code matches, but the street address doesn’t match

- Example:

- Merchant provided data: 55 Test Road, AB1 2CD

- Address data at Enfuce: 55 Test Street, AB1 2CD

- Example:

- The street address matches, zip code doesn’t match

- Example:

- Merchant provided data: 55 Test Street, AB3 4PD

- Address data at Enfuce: 55 Test Street, AB1 2CD

- Example:

- Neither zip code nor street address match

- Example:

- Merchant provided data: 55 Test Road, AB3 4PD

- Address data at Enfuce: 55 Test Street, AB1 2CD

- Example:

- Address data not available for verification

- Merchant provided data: 55 Test Road, AB3 4PD

- Address data at Enfuce: –

The outcome of the address verification does not influence the authorisation response, i.e. if the authorisation is declined or approved. The authorisation can be approved (and funds blocked) even if the address verification is unsuccessful. We pass on the result of the address verification to the merchant and the decision to accept the purchase or to cancel the transaction is the responsibility of the merchant.