Introduction to transactions

All transactions have one common characteristic. They are designed to either increase or decrease the account balance. The term ‘transaction’ includes all transaction-related communication between the merchant, an issuing processor and the issuer.

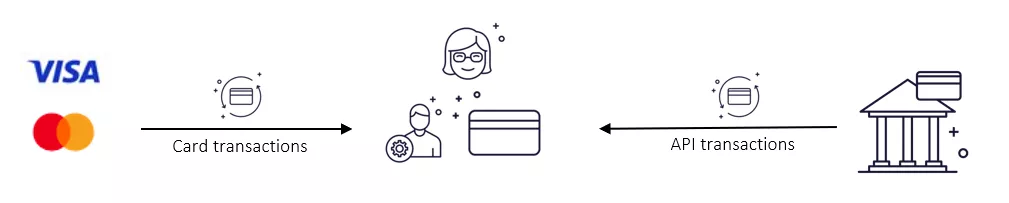

This guide explains the entire transaction flow from authentication to settlement. It covers all the different types of transactions; ones that originate from card schemes, all API-triggered transactions, and transactions that come from other sources.

All transactions, regardless of their type, are recorded in Enfuce in the same way and their data is available through the same access points: the Transaction API and the data export transaction file.

There are multiple aspects of transaction processing:

- Authentication

- 3DS

- Risk-based authentication

- Authorisation

- Technical validations

- Business validations

- Fraud validations

- Financial transaction

- Card scheme transactions

- API-triggered transactions and fees

Card scheme connectivity

Enfuce hosts gateways towards Visa and Mastercard, enabling the processing of authorisations and transactions from card schemes. Enfuce handles all the maintenance related to these gateways and the responsibility for their high availability.