Dispute management

Dispute management service

Dispute management includes the initiation and management of your customers’ payment disputes. Dispute management is required by the card schemes and by local legislation. Enfuce provides a dispute management service for issuers, supporting your customer service and helping recover losses.

Through this service, we can seek for a resolution for disputed payment transactions for you. The dispute can be initiated by your customer or by yourself, depending on the nature of the dispute. Dispute management supports your customer service, policies, guidelines and business decisions towards your cardholders.

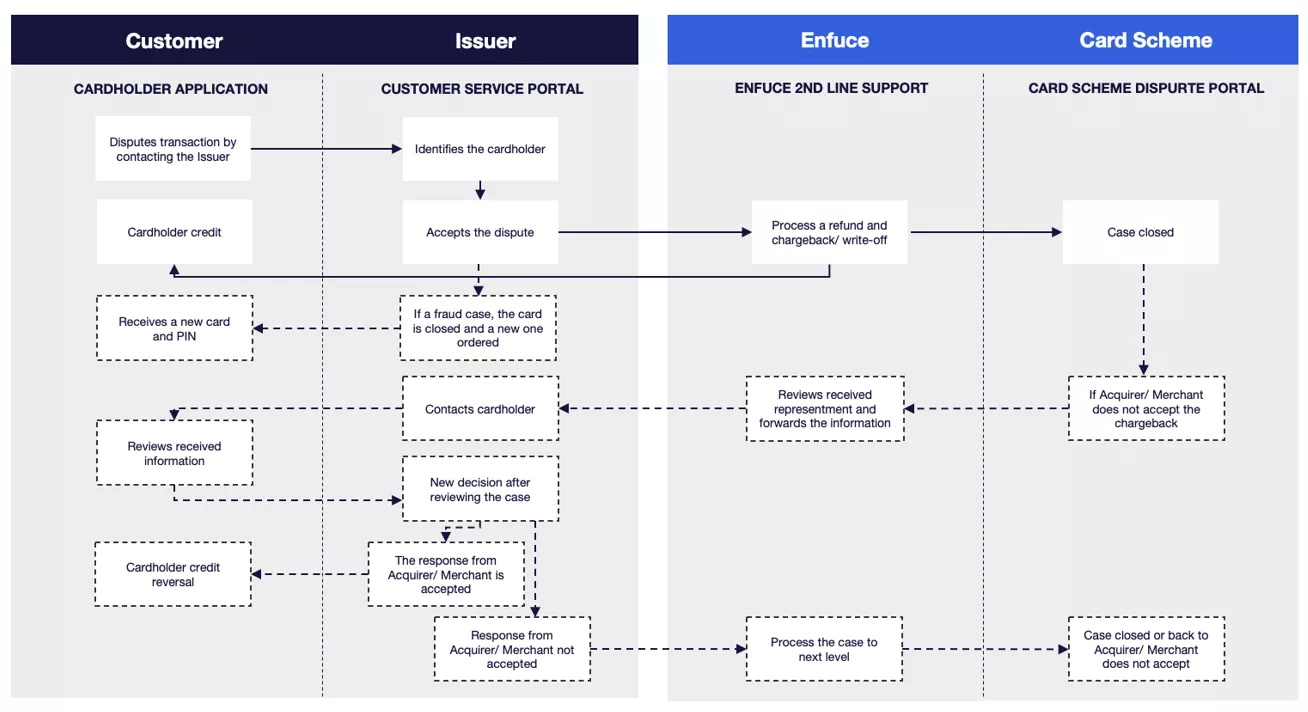

Here’s how the dispute management service flows:

The cardholder contacts your customer service to dispute a transaction. Your customer service validates the dispute according to your guidelines and policies, and that those are aligned with the card agreement and terms as with the local legislation.

Enfuce can be consulted for support to validate the dispute case. The case is sent to Enfuce’s support with sufficient details of the case to avoid any misunderstandings and with possible action points, e.g. to process cardholder credit. The possible supporting documentation must be translated to English.

In rare cases, if the dispute case continues within the card scheme’s dispute process with a response from the opposite member, Enfuce forwards the received response and documentation for a review. The response may require a review from your customer. If your customer continues the dispute, every subject from the dispute response must be addressed or re-asserted by them to continue the case according to the card scheme dispute rules.

The end resolution of the dispute case is one of the following:

- The disputed funds are recovered in the card scheme dispute process.

- The dispute amount is written off as loss for the issuer.

- The cardholder will be liable for the transaction amount.

As part of our service, Enfuce produces fraud reporting to card schemes on your behalf, and processes cardholder credits, chargebacks and write-offs, arbitration cases and compliance cases.