Start developing with Enfuce

Congratulations on taking the first step to building flexible, modern payment cards! You are probably eager to get going and start creating your card product. Here’s how that works:

- Get the quick intro on how Enfuce is set up on this page.

- Create your account here or sign in here to try our sandbox to see how our APIs function and what they can do.

- Reach out to us for personal API access if you’d like to test how integrating our APIs to your solution would work.

- After becoming a customer, agree on product scope and start your implementation project.

- Transition from sandbox to your personal demo environment – this environment is configured to fit your product.

- Go into production with us to produce cards and live transactions.

- Manage your card portfolio and access back office operations in our customer portal.

How Enfuce is set up

Basic entities in card issuing and accounts management

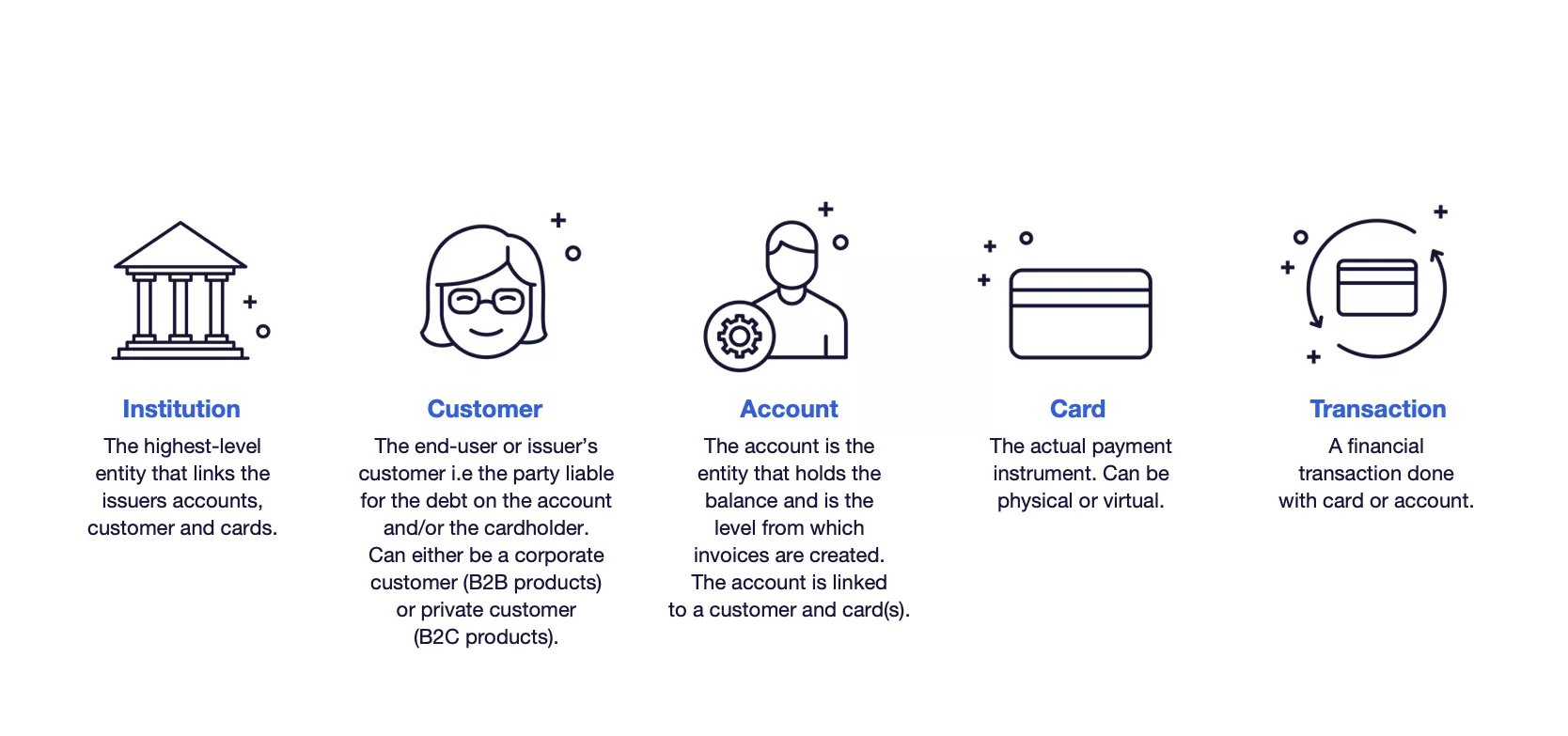

Our solution consists of five basic entities that are linked to each other:

Institution

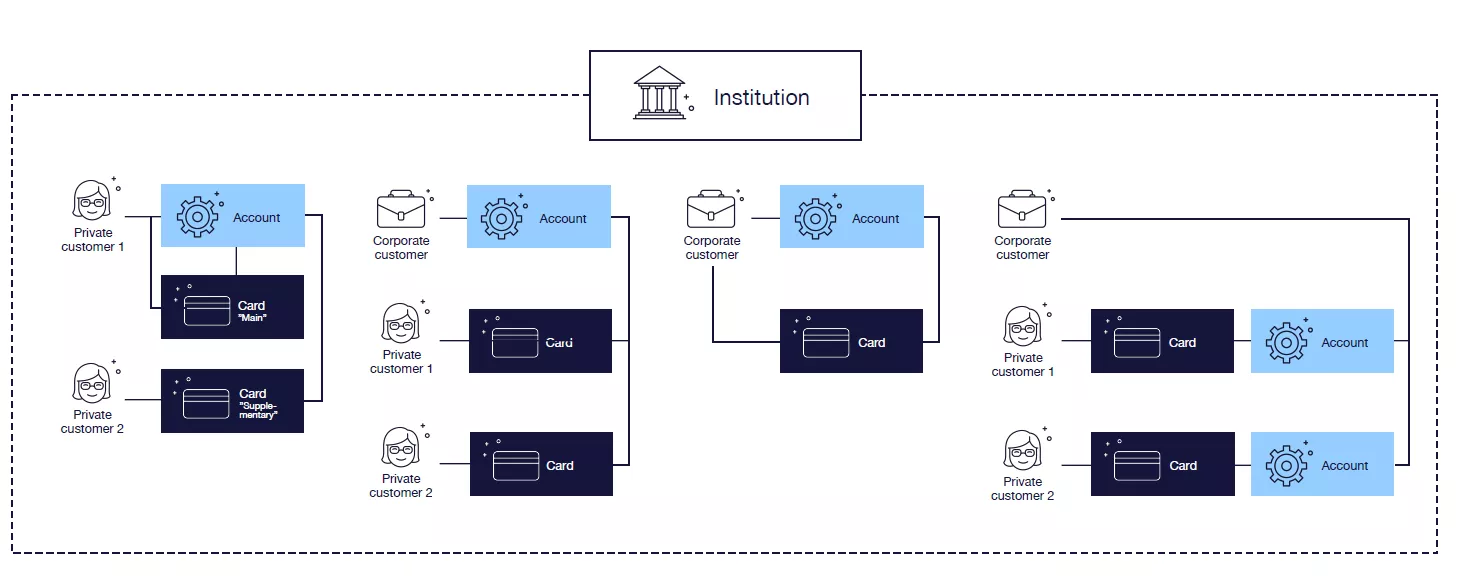

The institution is an umbrella entity that links accounts, cards and customers. When setting up the institution, Enfuce configures the products (debit/credit/prepaid) that are enabled for the institution.

Most of our issuers operate in multiple countries and we see country borders are fading – in EEA/EU the barriers are low for expansion into multiple countries. In order to support you in your market expansion, launching in a new country needs to be fast and profitable. With this in mind, one institution can hold products issued in multiple countries and currencies and usually issuers opt for a single institution setup. Besides being cost-effective, this setup also enables you to utilise the same API integrations and processes for all of your customers, regardless of country or currency.

Customer

A customer is the entity to which a card and/or account is issued to. The customer can either be a private person or a corporate customer. For more information, please refer to the Customer section.

Account

The main functionality of the account entity is to hold the balance. It can also be the link for several cards sharing the same balance. The account entity differs depending on the product (credit/debit/prepaid). For more information, please refer to the Account section.

Card

The card acts as the actual payment instrument. There is one card entity per card number. The card is linked to an account and a customer. The card entity holds data related to the card, like card-specific usage limiters and card delivery type. For more information, please refer to the Card section.

Transaction

A transaction represents a financial process where either the account balance increases or decreases. The transaction can be a transaction done with a card, triggered via (API) or, for instance, posted based on input from a 3rd party. Regardless of the source, the characteristics are the same, when posted it will either increase or decrease the balance. For more information, please refer to the Transaction section.

Together these entities form an entirety where the institution is the link between all customers, accounts and cards issued by an issuer. The customer/account/card -unit forms the base for a functioning payment solution for the end-user.

Creating customers, accounts and cards

The customer lifecycle starts with the onboarding of a new customer. It should be noted that prior to this process, the issuer is expected to have screened the applicant, performed required KYC/KYB process and gathered the needed data to be able to initiate the customer creation process at Enfuce.

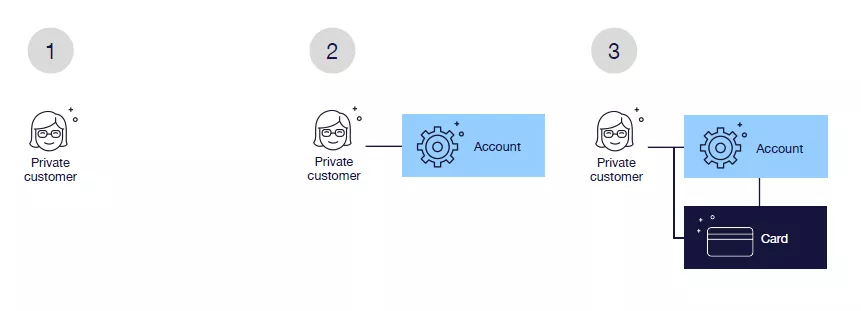

As described previously, the customer, account and card entities together form the needed parts to create a complete unit. You can create one following an easy three-step process:

- Create a customer → the response will return customerId needed in step 2 & 3. Create a customer.

- Create an account → the response will return accountId needed in step 3. Create an account.

- Create a card. Create a card.

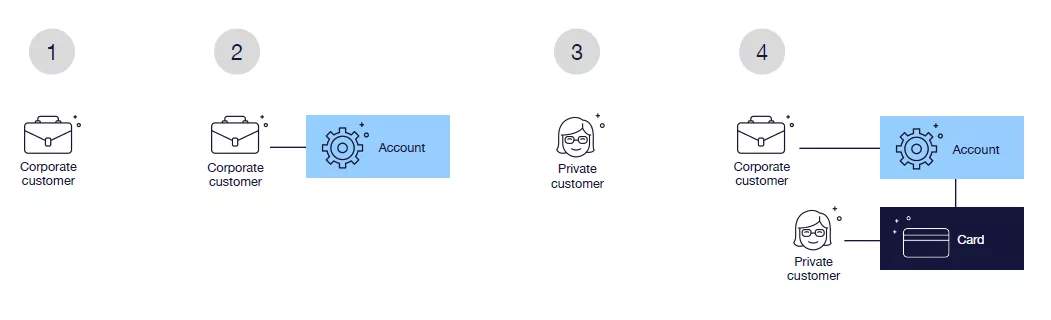

Depending on the use case, the cardholder linked to the card can be different than the customer linked to the account in which case you’ll have to create two separate customers.

- Create a customer that owns the account → the response will return customerId needed in step 2. Create a customer.

- Create an account → the response will return accountId needed in step 4. Create an account.

- Create a customer that owns the card → the response will return customerId needed in step 4. Go to Customer API.

- Create a card. Create a card.

There are multiple variations possible depending on the issuer value proposition. The logical process of creating entities however remains the same.

The customer, account and card are created immediately in Enfuce payment platform and are available for use as soon as the API request is confirmed to have been successful. In the responses the issuer will receive the IDs for each entity that will be the primary keys for respective entity during its lifecycle. The IDs can be used to get and update the information related to each entity.

The created Customers, Accounts and Cards will be reflected in the Data export files on the following day.