Customer

What is a customer?

A customer is the entity to which a card and/or an account is issued to. A customer can be a private person, a corporate customer, or even an item, like a vehicle. The customer entity is used to identify to whom the account and/or card is linked to. The basic logic is that the customer linked to the account is considered the owner of the account and liable for the debt on the account and the customer linked to the card would be considered the cardholder.

The customer entity holds the following information (required fields marked with*):

- Name

- Private:

salutation, firstName*, middleName, lastName*

- Private:

- Corporate:

name*- Date of birth (

dateOfBirth)

- Date of birth (

- Contact information

email, phoneNumber, mobileNumber, address*

- Language (

locale*) - Customer identifiers (

customerNumber*, regNo*)- Customer number can e.g. be a CRM number or VAT-number

- Registration number: For example the social security number of the customer

To note:

Corporate customers are not necessarily actual persons. They can be departments, vehicles, cost centers, etc. Due to this, the required information differs somewhat between private and corporate customers.

Please refer to the API documentation for details.

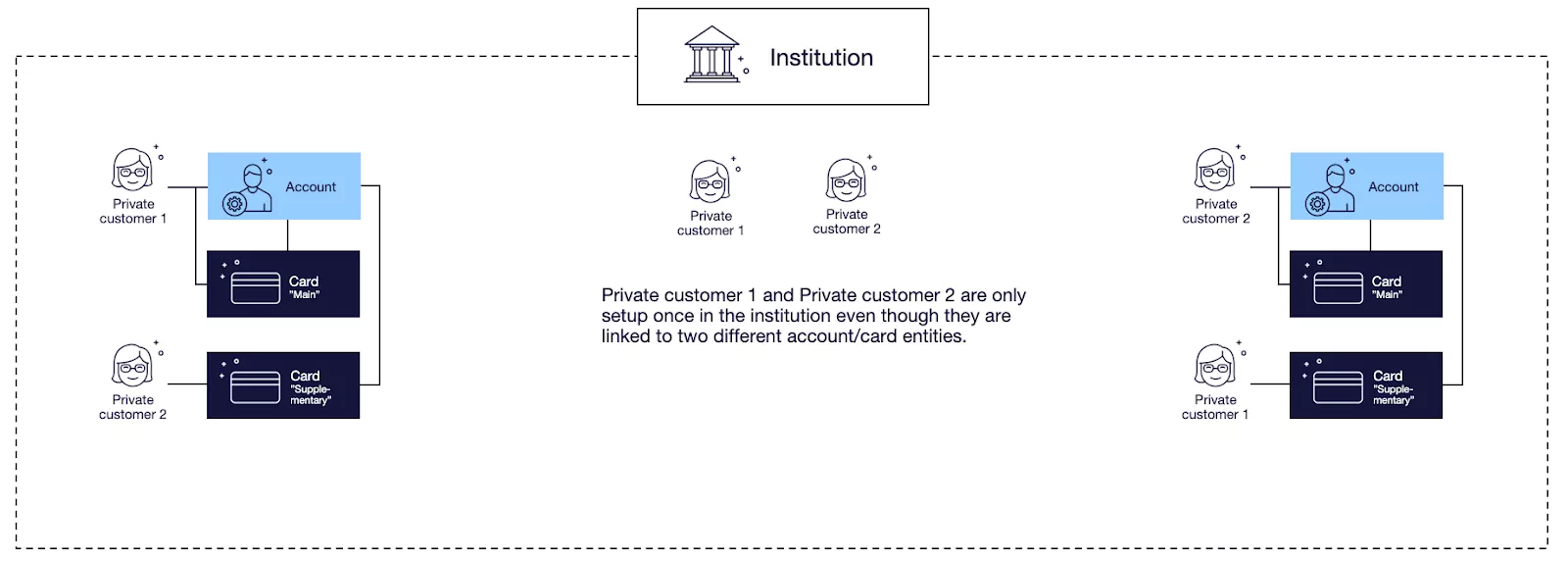

Enfuce recommends that one customer is only represented once in the institution. Even if a customer has several accounts and cards in one institution, the same customer entity should be used and linked to all accounts and/or cards, instead of creating multiple customers to represent the same person/department/item.

This way, the same customer information is presented, regardless of which account or card is observed within the institution. Below is an example situation.

If you support digital wallets, it is required that each card have a separate customer linked to them. This is required especially to support SMS OTP (one-time-password) which requires a valid phone number per customer. SMS OTP is often used as a fallback enrollment method which is required by the digital wallet providers (Apple Pay, Google Pay, Samsung Pay).

Customer onboarding process and customer data

Enfuce is agnostic to the onboarding and the application process performed by the issuer. Enfuce assumes that the onboarding, including KYC/KYB, screening, application and possible creditworthiness process is performed and pre-approved by yourself before your customer is set up in the Enfuce system.

After you’ve onboarded your customer, the customer and the account including the card for the customer will be created in the system. Customer creation through the API is described here.

You remain the owner of the customer data and you are responsible for keeping the data up to date. Enfuce records all data received through the creation and update functions and reflects them in the API view functions and Data Export files. The data is also used in the card printing and statement processes.

Customer-level base address and other possible addresses

Enfuce enabled flexible address configuration on different levels: Customer, Account, and a Card level. Customer-level address always works as a primary address and if other addresses are not defined, the Customer level base address will be used.

Different addresses Enfuce enables:

- Customer-level base address (address): This is the primary address for a customer and can include additional contact information such as phone numbers and email addresses.

- Customer-level temporary address (temporaryAddress): This address overrides the customer-level base address

- Account-level statement address (address): An optional address for statement and invoice deliveries. This overrides the customer-level base address and will be forwarded with the statement/invoice files.

- Card-level PIN delivery address (pinAddress): An optional address specifically for PIN delivery. This address is forwarded with the embossing file.

- Card-level Card delivery address (cardAddress): An optional address for card deliveries, also forwarded with the embossing file.