Revolving credit product – Interest accrual

Enfuce offers several options for the interest calculation. The interest calculation model is usually determined by the terms and conditions agreed with the customer and it’s also potentially guided by local legislation. We support several variations to meet the requirements of the multiple markets where we operate (EU/EEA and UK). All interest models are calculated daily based on 365/366 days.

An example: A balance of £100 that accrues 15% interest for 10 days

The interest is calculated by multiplying the balance (100) with the interest rate (0,15) and the number of days (10) and dividing this with a factor reflecting the number of days in the year (365):

100 * 0,15 * 10 / 365 = £0,41

The interest is calculated every day based on the opening balance of the day of the interest accruing technical account. Even though the interest is calculated every day, it is posted only at the end of the billing cycle. This is to avoid an invoice with a separate interest transaction for each day of the billing cycle, making for a lengthy invoice and a confusing end-user experience.

Configurable interest calculation options

Which balances is interest calculated for?

As described in the segregation of balances page, balances are split by purpose (retail, cash, fee, interest, overdue interest). This split allows you to determine whether to collect interest for each of these options. You might want to accrue interest on cash but not on fees.

In some markets, it is common to accrue interest on interest (compound interest). If this is enabled, it is good to note that interest on interest starts to accrue from the day the interest is posted, which is the billing date.

When does interest accruing start?

You can choose if accruing interest starts from the day a transaction is posted or only after a grace period (due date + potential grace days).

How much is the interest rate?

The interest rate is defined by you and can differ between balances in the ledger as well as between customers. For example, interest for cash can be set higher than interest for retail balances. Interest rates can also be determined based on a customer segment and you can set a lower rate on valued customers and a higher rate on new or more risky customers.

Do you want a separate interest on overdue balance?

In some markets interest on overdue balance is more regulated and there can be a need to have separate interest rates on interest accrued on balances that are revolving and overdue balances.

An example:

Each cell in the below table represents a configurable parameter.

| Current | Grace | Billed | Overdue | |

|---|---|---|---|---|

| Retail | 0% | 0% | 15% | 15% |

| Cash | 15% | 15% | 15% | 15% |

| Fees | 0% | 0% | 15% | 15% |

| Revolving interest | 0% | 0% | 0% | 0% |

| Overdue interest | 0% | 0% | 0% | 0% |

The above table describes an example setup, where:

- Interest is accrued on retail, cash and fees (Which balances is the interest calculated for?)

- For cash transactions from the transaction posting date, retail and fees after the grace period (When does interest accruing start?)

- All interest rates are set at 15% (How much is the interest rate?)

- No separate interest rate on overdue balance (Do you want a separate interest on overdue balance?)

Revolving interest and overdue interest

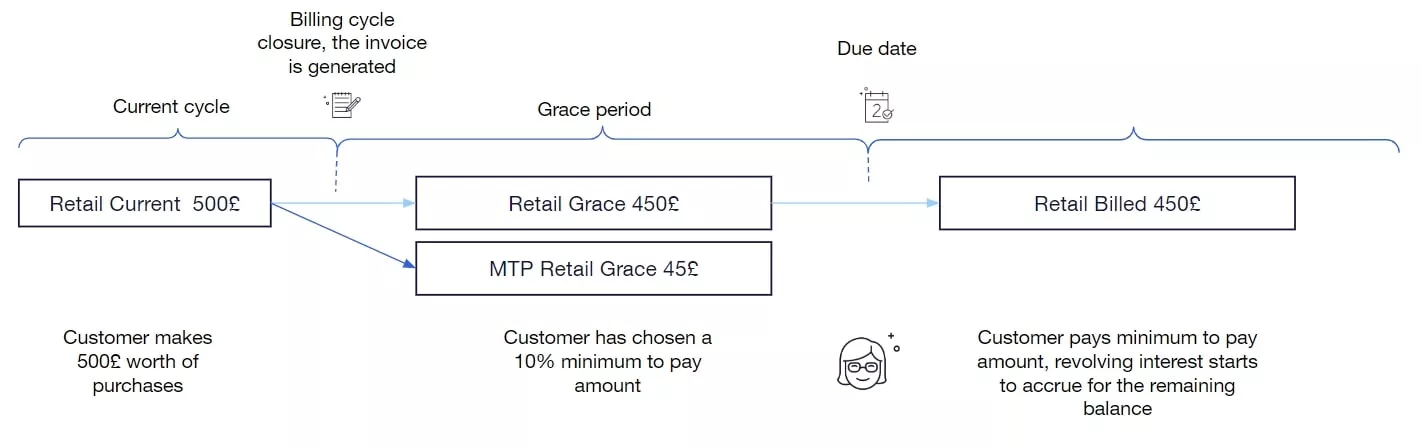

Revolving interest is accrued on the outstanding revolving balance. If the customer, rather than paying the full invoiced debt, pays a minimum amount, the balance remaining is considered a revolving balance.

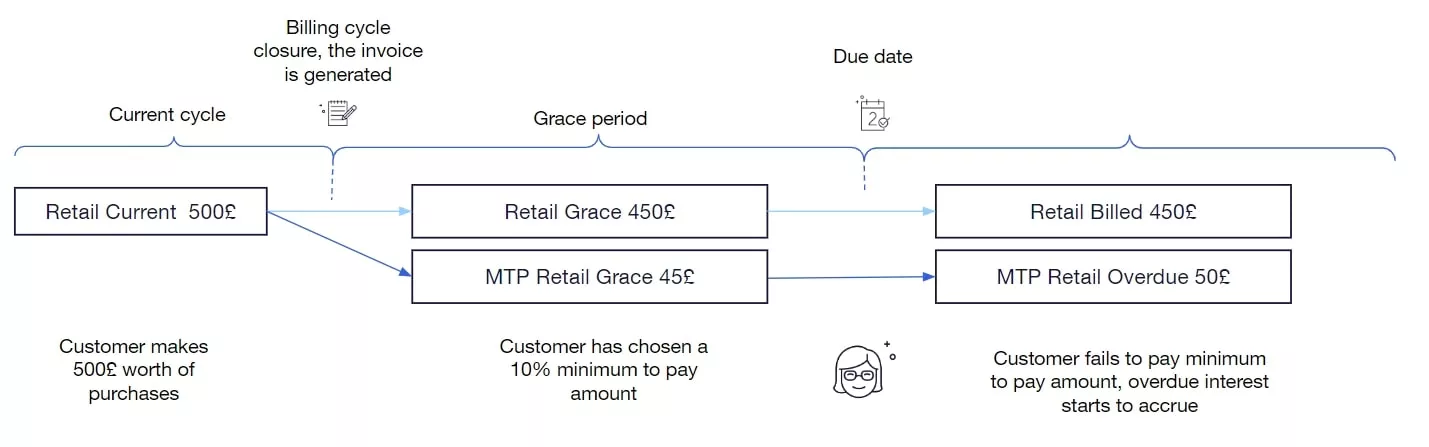

Overdue interest is accrued on an overdue balance. If the customer fails to pay the minimum amount, the minimum amount (or what is left of it) is considered an overdue balance, which can have a separate interest charge set to it.

Interest waiving

If interest accrual is started from the transaction posting date, it is possible to waive the interest in case the customer pays the entire debt by the due date. This setup allows you to accrue interest from the earliest date possible, while simultaneously making it possible for the customer to avoid the interest by paying the entire debt.

An example:

A customer makes a £500 purchase. The due date is 20 days after the transaction has been posted. Enfuce will accrue interest for 20 days, but if the customer pays off the entire debt of £500 by the due date, the accrued interest is waived.

You can choose to offer the interest waiving option only after one or two full payments. This means that you have the option to configure the interest so that if a customer has only paid a minimum amount in January and February and then pays off the outstanding debt in March, this first full payment will not trigger interest to be waived, it’s only activated from the second full payment.

It should be noted that interest waiving is active for newly created customers from the first billing cycle.