Revolving credit product – Reminder and collection process

The standard credit product setup includes an automated reminder and collection flow that allows you to effortlessly remind your customers of any overdue balance. This decreases credit risk and is required in many markets to be compliant with legislation and regulation. The default process is that an end-customer is reminded twice of the overdue debt before sending the debt to collection.

The reminder and collection processes are automated and all actions are triggered according to predefined rules that are set during the implementation project. The rules you get to define are:

- How many days after the due date should the first reminder be sent?

- What is the fee for the first reminder?

- How many days after the due date should the second reminder be sent?

- What is the fee for the second reminder?

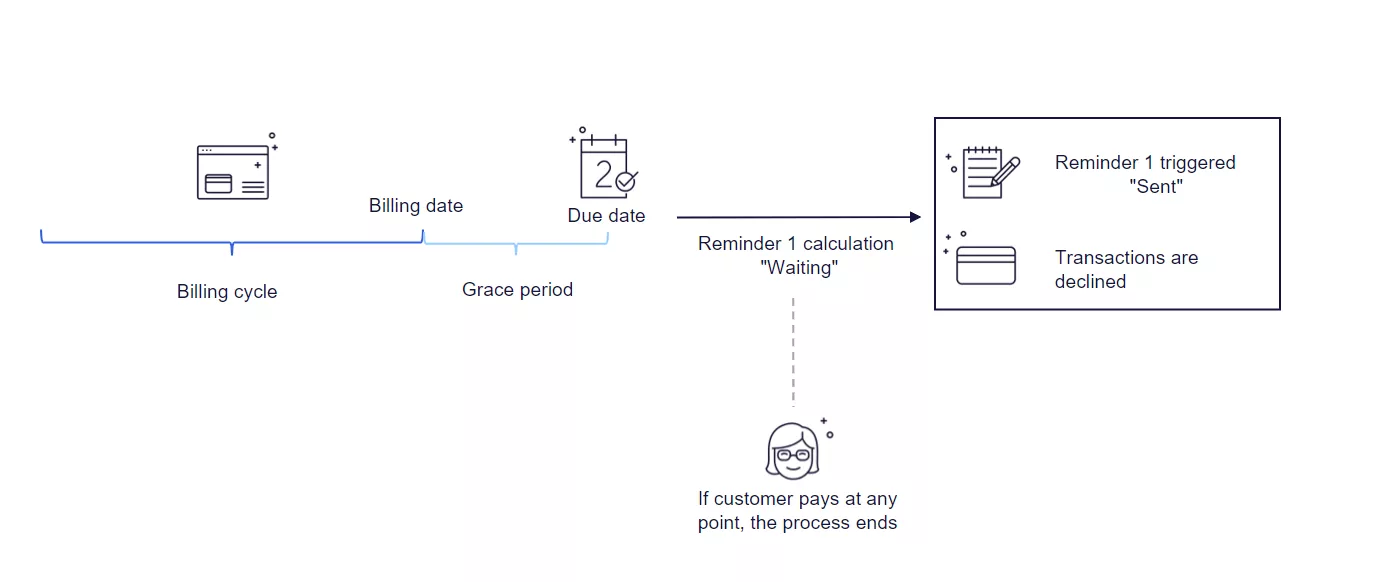

As described in a separate section, balances on a credit product are segregated and age as the billing cycle closes and due dates are passed. If there remains a balance in the minimum-to-pay (MTP) accounts the day after the due date has passed, the reminder process is triggered.

First reminder for an overdue invoice

Enfuce will start calculating the reminder days when there is an unpaid due balance after the delinquency date. The delinquency date is set per issuer definitions during the implementation project as days after the due date. The calculation start date is indicated in the daily data export files by the account property ‘CL_REM1_ST’ which is updated to ‘W’ (Waiting) after the due date. The account is constantly monitored and the calculation stops in case the customer makes a payment that covers the entire overdue balance. If a payment is received before the reminder is sent, the ‘CL_REM1_ST’ property is updated from ‘W’ (Waiting) to ‘N’ (No) during the End of Day processes.

If the customer does not pay the overdue balance by the time the predefined amount of days since the delinquency date has passed, the account property is updated from ‘W’ (Waiting) to ‘S’ (Sent). Simultaneously the potential fee for the first reminder is posted on the card account. Sending reminder 1 is also the default threshold for when the account will be considered blocked, i.e., all authorisations will be declined due to delinquency. While the authorisations are declined, the status of the account or cards will not change. When the full payment is received, the account and cards will be unblocked immediately when the payment is posted to the card account.

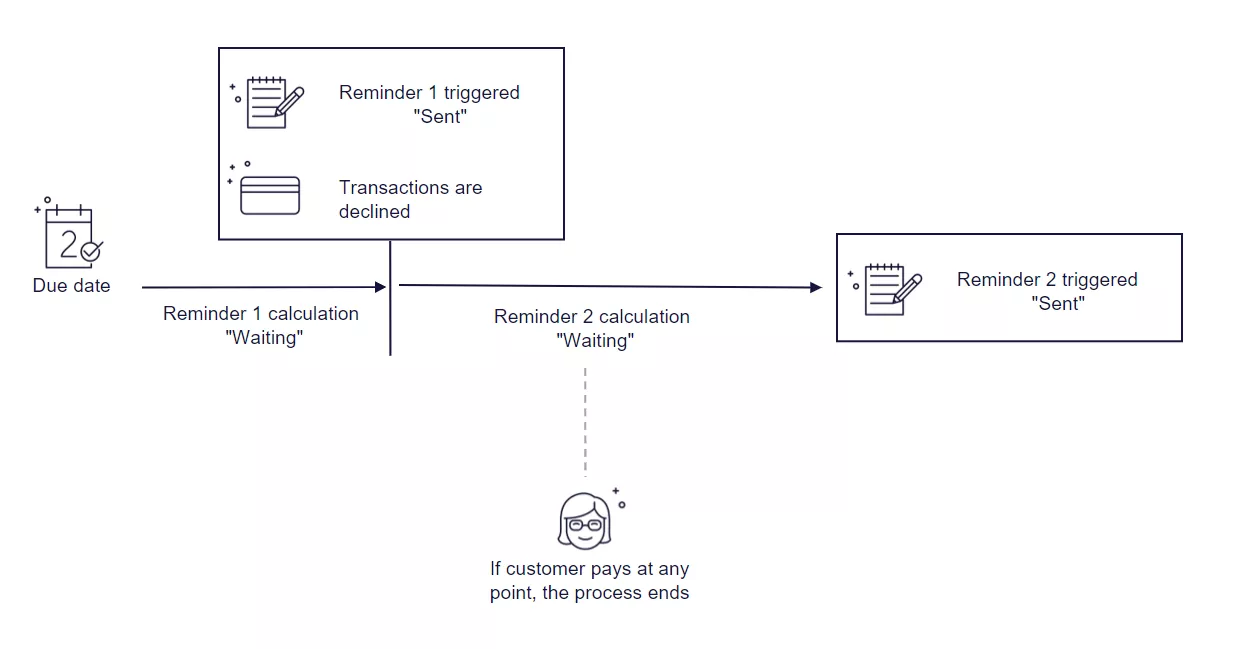

Second reminder for an overdue invoice

As soon as the account property ‘CL_REM1_ST’ property is updated to ‘S’ (Sent), Enfuce will start calculating the days for the second reminder. This calculation start is reflected in the account property ‘CL_REM2_ST’ which is updated to ‘W’ (Waiting). The same monitoring of the account applies for the second reminder and the calculation stops in case the customer makes a payment that covers the entire overdue balance. If a payment is received before the reminder is sent, the ‘CL_REM2_ST’ property is updated from ‘W’ (Waiting) to ‘N’ (No).

If the customer does not pay the overdue balance by the time the predefined amount of days since the first reminder was sent, the ‘CL_REM2_ST’ account property is updated from ‘W’ (Waiting) to ‘S’ (Sent). Simultaneously the potential fee for the second reminder is posted on the card account. As the second reminder is actualised (i.e. ‘Sent’), the calculation for sending to collection starts.

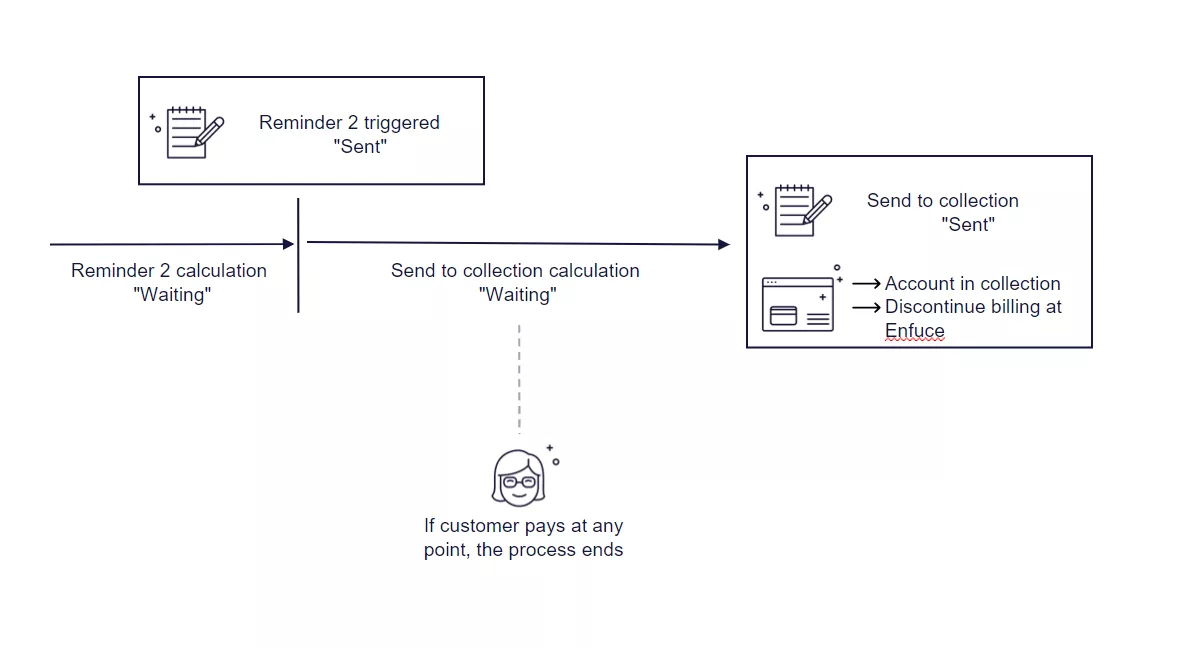

Collection process for revolving credit

As soon as the account property ‘CL_REM2_ST’ property is updated to ‘S’ (Sent), Enfuce will start calculating the days for sending to collection. This calculation start is reflected in the account property ‘CL_COLL_ST’ which is updated to ‘W’ (Waiting). The same monitoring of the account applies for sending to collection and the calculation stops in case the customer makes a payment that covers the entire overdue balance. If a payment is received before sending to collection, the ‘CL_COLL_ST’ property is updated from ‘W’ (Waiting) to ‘N’ (No).

If the customer does not pay the overdue balance by the time the predefined amount of days since the second reminder was sent, the ‘CL_COLL_ST’ account property is updated from ‘W’ (Waiting) to ‘S’ (Sent).

Sending to the collection will trigger the following actions at Enfuce:

- Interest accrual will be discontinued

- Card account will be excluded from statement generation (as debt collection is expected to be continued by the collection agency)

- Account status is updated to ‘Account In Collection’

Based on the updated ‘CL_COLL_ST’ account property in the daily data export files, you can take action and initiate the collection process with your chosen debt collector.

The card account and balance will remain in the Enfuce system even after the status has been updated to ‘Account In Collection’, and the issuer can continue to post payments to the account to reflect any potential payments the customer has done to the collection agency.

Write-offs in revolving credit

It is common for issuers to write off a debt when debt collection fails. When and based on which rules, is based on your policy.

Write-off for a card account debt is issued through the Update Account API. This will clear off all open balances within each technical account. You will have a full audit trail of the balance types that have been written-off (principal, fees, interest). In case of a partial or positive balance write-off, the write-off is done through a support ticket to Enfuce. Enfuce specialists will ensure that the write-off is done correctly.

As the balances are written off, they are posted to specific Write-off GL accounts, which will allow the issuer to have the necessary data for bookkeeping and regulatory reporting.